By Omkar Godbolole (all time and unless otherwise indicated)

The cryptographic market is positively quoted with the Fed risk event, focusing on positive ones such as the friendly president with the cryptographic in the White House, the renewed increase in the Tether market and the effect of the Chinese New Year.

Among the cryptocurrencies with market valuations of more than $ 5 billion, the prominent interpreter is Litecoin (LTC), the gold to Bitcoin’s gold, which has jumped more than 11% from the first Asian hours compared to the 1 % to 3% for rest. It is the third best performance of the 100 main currencies in the last 24 hours, thanks to the SEC that recognizes the proposal of ETF of Litecoin de Canary Capital. That has been opened for public comments, a movement that suggests a possible approval in the coming months.

“This is the first presentation of ETF Altcoin to be recognized,” said Bloomberg’s senior analyst Etf, Eric Balchunas, in X, pointing out that the proposal is the one that advances the most in the regulatory requirements.

A potential list could be as positive for LTC as it has been for BTC and ETH. Keep in mind that despite the increase in prices at $ 130, LTC is still well below the record success of $ 410 in 2021. Its price chart shows a constructive perspective (see the technical analysis section below).

In other key developments, the activity in the chain tracked by Glassnode shows a lower level of retail participation in BTC right than in November. That is encouraging for bulls looking for signs about whether the last movement above $ 100,000 is sustainable. Meanwhile, Lombard Finance is becoming more dominant in Bitcoin’s rethinking space, capturing a giant part of the total BTC this week.

The number of active Ethereum addresses recently exceeded a maximum of March 2024, indicating a renewed increase in the chain activity, according to Intotheblock data. The price of Ether has crossed over $ 3,200, but has not yet clear the bold trend line that connects the maximums of December 16 and January 6.

In traditional markets, the 10 -year reference treasure yield has decreased to 4.50%, visiting the minimum of Monday in an upward movement for risk assets. BTC optimists may be waiting for the central PCE inflation of the United States to arrive later later today, which drives the performance of the bonds even lower.

That said, we will also obtain the GDP of the fourth quarter together with the weekly unemployment claims report. Meanwhile, European gasoline prices have increased to a maximum of 15 months and could inject some volatility in risk assets. Stay alert!

What to see

- Crypto:

- January 31: Crypto.com suspends the purchases of USDT cryptocurrencies, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO and XSGD in the EU to comply with the Mica Regulations. The withdrawals will be supported until q1.

- February 2, 8:00 pm: Core Blockchain Athena Hard Fork Network Update (V1.0.14)

- February 4: Pepecoin (Pepe) in half. In block 400,000, the reward will fall to 31,250 PEPE.

- February 5, 3:00 PM: The update of the Holocene Holocene Network fork network for its Ethereum-based Mainnet Mainnet.

- February 5 (after market closure): Microstrategy (MSTR) T4 Fy 2024 profits.

- February 6, 8:00 am: Update of the SHENTU chain network (V2.14.0).

- February 11 (after market closure): Exodus movement (exod) P4 2024 profits.

- February 12 (before the open market): Hut 8 (HUT) P4 2024 profits.

- February 13 (after market closure): Global Coinbase (COIN) Q4 2024.

- February 15: Qtum (Qtum) Hard fork Network Current in block 4,590,000.

- February 18 (after market closure): Semler Scientific (SMLR) Q4 2024 profits.

- February 20 (after market closure): block (xyz) Q4 2024 profits.

- February 26: Mara Holdings (Mara) P4 2024 profits.

- February 27: Riot Platforms (Riot) P4 2024 profits.

- Macro

- January 30: At a meeting of the Junto National Bank, Governor Aleš Michl presents his plan for the Central Bank to adopt Bitcoin as a reserve asset.

- January 30, 8:15 am: The ECB announces its interest rate decision. This is followed by a press conference at 8:45 AM Livestream Link.

- Installation deposit rate Est. 2.75% vs. Prev. 3%.

- Main refinancing rate Est. 2.9% vs. Prev. 3.15%.

- PREVING MARGINAL LOAN RATE. 3.4%.

- January 30, 8:30 am: The United States Economic Analysis Office (BEA) releases the Fourth Quarter GDP Report.

- GDP growth rate QOQ Est. 2.8% vs. Prev. 3.1%.

- GDP Price Index QOQ Est. 2.5% vs. Prev. 1.9%.

- Initial unemployment claims for the week ending on January 25 EST. 220k vs. Prev. 223K.

- Continuing unemployment claims Est. 18900K vs. Prev. 1899K.

- PCE prices QOQ Est. 2.5% vs. Prev. 2.2%.

- PCE PRICES QOQ Prev. 1.5%.

- Real consumer expense QOQ Prev. 3.7%.

- January 30, 4:30 pm: The Public Federal Reserve H.4.1 Report on factors that affect reserve balances for the week ending on January 29.

- BALANCE GENERAL PREV. $ 6.83T.

- January 30, 6:30 pm: The Ministry of Internal Affairs and Communications of Japan publishes the December unemployment report.

- Est. 2.5% unemployment rate. Prev. 2.5%.

- January 30, 6:50 PM: Report of the Ministry of Economy, Commerce and Industry of Japan of December December (Preliminary) Production Report.

- Industrial Production Mom Est. 0.3% vs. Prev. -2.2%.

- Industrial production Yoy Prev. -2.8%.

- Mom retail sales 1.8%.

- Retail sales yoy est. 3.2% vs. Prev. 2.8%.

- January 31, 8:30 am: The United States Economic Analysis Office (BEA) publishes the December 2024 personal income report and disbursements.

- Core PCE Price Index Mom Est. 0.2% vs. Prev. 0.1%.

- Central PCE Price Index Yoy Est. 2.8% vs. Prev. 2.8%.

- PCE Price Index Mom Est. 0.3% vs. Prev. 0.1%.

- PCE Price Index Yoy Est. 2.6% vs. Prev. 2.4%.

Token events

- Government votes and calls

- Rarible DAO is voting if it gives the RARI Foundation a mandate to collaborate with raribles on the implementation of the collection of multicin protocol rates and the design of a primary protocol rate structure for NFT mints.

- Cow DAO is voting to give its main treasury team an assignment of 80 million cows to support liquidity supply, treasure growth and products development for COW DAO from 2025 to 2028.

- Synapse Dao votes to update Syn Token to CX from the Cortocol and the holders of both enjoy the same value.

- You unlock

- January 31: Optimism (OP) to unlock 2.32% of the circulating offer worth $ 46.39 million.

- February 1: SUI (SUI) will unlock around 2.13% of its circulating supply for a value of $ 261.91 million.

- February 2: Ethena (ENA) will unlock around 1.34% of its circulating supply for a value of $ 29.53 million.

- Tokens listings

- January 30: Pepe (Pepe) will be listed in Bitflyer.

Conferences:

Token talk

By Shaurya Malwa

- The gelatin token rose to a market capitalization of $ 200 million in the last example of web2 start founders who launched their own tokens.

- The Token was released by Sam Lessin, co -founder of Venmo, to start and win traction for a new video chat application called Jelly.

- Jelly is integrated into Jelly Esports, which includes features such as Solana Boxes, a loot cash game where players can win luxury items spinning with jelly sun or tokens.

- Gelatin use rates are dynamically assigned to ardor, stagnation, provision of liquidity, gamification and equipment support.

Derivative positioning

- The open interest of the future perpetuals of Litecoin has increased almost 20% in 24 hours with a net signaling signal of the positive net or positive volume (CVD).

- TRX, SUI and BTC also boast of a positive net ECV.

- The BTC and ETH CME futures premiums mark higher in a signal of merchants pursued by the upward exposure.

- In Delibit, BTC and ETH calls continue to operate more expensive than puts. Block flows have been mixed, with Calendar Spreads and short Vol strategies such as short Straddles.

Market movements:

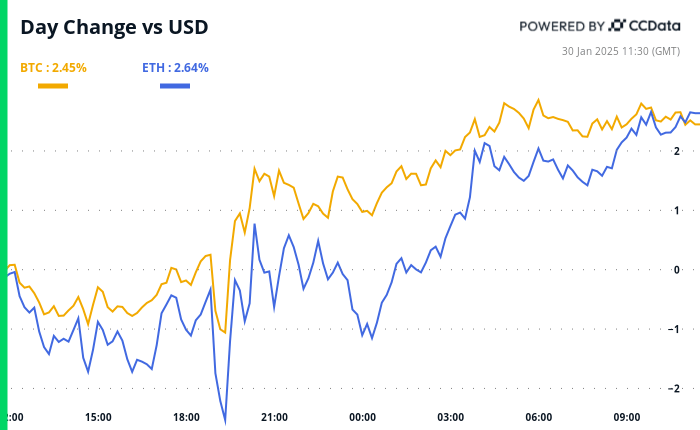

- BTC increased 0.86% of the 4 PM ET on Wednesday to $ 105,190.06 (24 hours: +2.46%)

- ETH increases 2.63% to $ 3,134.98 (24 hours: +2.62%)

- COINDESK 20 increases 1.74% to 3,826.50 (24 hours: +2.41%)

- The commitment rate composed of CESR has dropped from 3 bp to 3.03%

- The BTC financing rate is at 0.0092% (10.12% annualized) in Binance

- DXY has not changed to 107.98

- Gold has increased 0.91% to $ 2,778.26/oz

- La Plata rises 1.11% to $ 31.05/oz

- Nikkei 225 closed +0.25% at 39,513.97

- Hang Seng closed +0.14% at 20,225.11

- Ftse has risen 0.34% to 8,587.03

- Euro Stoxx 50 has increased 0.73% to 5,269.01

- Djia closed on Wednesday -0.31% to 44,713.52

- S&P 500 Closed -0.47% at 6,039.31

- Nasdaq closed -0.51% to 19,632.32

- The closed S&P/TSX compound index +0.21% at 25,473.30

- S&P 40 Latina America closed without changes at 2,336.48

- The 10 -year treasure of US has dropped 3 bp with 4.51%

- E-mini s & p 500 Futures rose 0.33% to 6,087.50

- E-mini nasdaq-100 futures rose 0.49% to 21,627.75

- E-mini dow Jones The industrial average index has risen 0.38% to 45,062.00

Bitcoin statistics:

- BTC domain: 59.53 (-0.51%)

- Bitcoin Ethereum Relationship: 0.03054 (1.73%)

- Hashrat (seven -day mobile): 774 eh/s

- Hashprice (spot): $ 62.2

- Total rates: 4.82 BTC/ $ 494,506

- CME Futures Open Interest: 170,105 BTC

- BTC with a gold price: 38.0 oz

- BTC vs Gold Market Cap: 10.80%

Technical analysis

- LTC has come out of a multimanth base pattern, indicating a renewed change of impulse.

- The resistance is seen at $ 150 followed by $ 300, with support of $ 86, the December Swing Low.

Cryptographic equities

- Microstrategy (MSTR): closed on Wednesday at $ 341.25 (+1.58%), 0.87% more at $ 343.86 in the previous market.

- Global Coinbase (Coin): Closed at $ 291.00 (+3.26%), 0.69% more at $ 293 in the previous market.

- Galaxy Digital Holdings (GLXY): closed to C $ 29.09 (+4.38%).

- Mara Holdings (Mara): closed at $ 18.42 (+0.88%), 0.87% more at $ 18.58 in the previous market.

- Riot platforms (Riot): closed at $ 11.22 (+2.47%), 1.52% more at $ 11.39 in the previous market.

- Core Scientific (Corz): closed to $ 11.88 (+1.33%), a 3.66% increase to $ 11.88 in the previous market.

- CleanSTark (CLSK): closed to $ 10.26 (+2.09%), an increase of 1.07% to $ 10.37 in the previous market.

- Coinshares Valkoie Bitcoin Miners ETF (WGMI): closed at $ 11.22 (+1.58%).

- Semler Scientific (SMLR): closed at $ 52.08 (-0.42%), less 0.15% to $ 52 in the previous market.

- Exodus movement (Exod): closed to $ 89.30 (+11.4%), 5.88% more at $ 94.55 in the previous market.

ETF flows

ETF flows

Spot BTC ETF:

- Daily net flow: $ 92 million

- Cumulative net flows: $ 39.6 billion

- Total btc holdings ~ 1.17 million.

Spot Eth Ethfs

- Daily net flow: -$ 4.82 million

- Cumulative net flows: $ 2.66 billion

- Total possession eth ~ 3.6 million.

Source: Farside Investors

Flows during the night

Figure of the day

- The box shows BTC spent by wallets owned by small and retail investors and whales.

- Small addresses currently spend $ 10.7 million in BTC every hour, a 48% decrease from the peak of $ 20.6 million in November.

While you sleep

In the ether