Litecoin

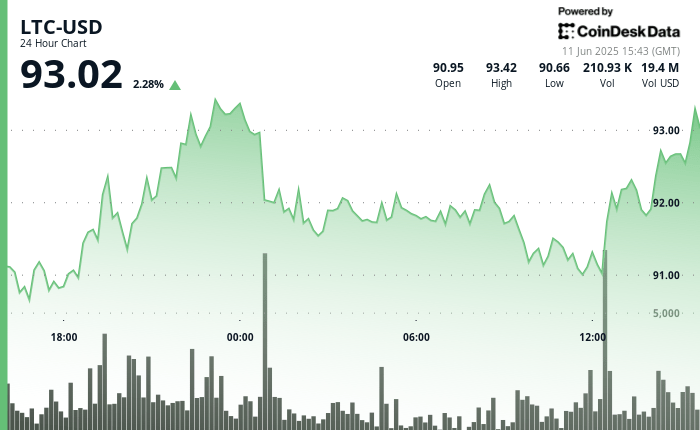

Retrieved from AM during the night for the sale of the night, increasing more than 2% and reaffirming support about $ 93. The rebound coincided with profits in traditional markets after an American CPI report cooler than expected.

The digital currency fell after midnight UTC, losing ground from a peak of $ 93.58, before attracting interest on the purchase side that helped stabilize the price of around $ 91.

The analysis suggests that market participants may be positioning ahead of a possible approval of the Litecoin Exchange Coterrician (ETF). Bloomberg James Seyffart analyst has assigned a 90% probability of such approval at the end of this year, placing LTC along with Sol de Solana

as leading candidates in a possible “Altcoin Etf Summer”.

General description of the technical analysis

The Litecoin price action varied from $ 90.97 to $ 93.58 in the last 24 hours, a SWING of 2.88%, according to the Coindensk Research technical analysis data model. The most steep fall occurred during the peak Asian negotiation hours, when the price fell 1.55% in minutes before obtaining support in $ 91.

As the merchants in the Americas woke up, the high -volume purchase pushed LTC by $ 92. The most intense trade occurred around noon UTC, with 249,812 sheets changing their hands and feeding a strong recovery.

It seems that an upward price channel is being formed, with resistance about $ 93.50 and consolidation support of around $ 91. Volatility shot again with a 3.4%drop, although prices stabilized shortly after, which suggests that the $ 91 floor remains under pressure.

LTC is now around $ 92.95, showing signs of constant recovery.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.