Litecoin

More than 2% were recovered on Monday, gaining ground as investors observe a possible approval of the fund quoted by the spot exchange (ETF) and sail for an unstable geopolitical background.

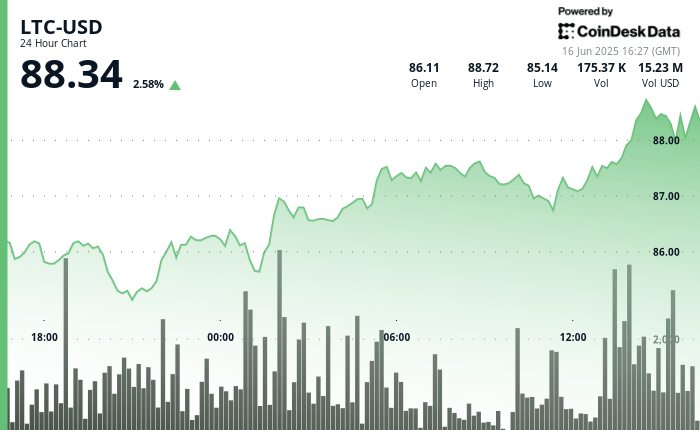

LTC increased from $ 85.05 to $ 88 in a 24 -hour period, a bullish trend marked by higher minimums and a heavy volume. The increase coincides with the growing expectations that the United States Stock Exchange and Securities Commission (SEC) could be seen Greenlight to an ETF Spot that provides exposure to investors to LTC.

According to Bloomberg ETF analysts, Eric Balchunas and James Seyffart, the probabilities of such approval are now 90%, while Polymket merchants are weighing 76% possibilities.

Meanwhile, whales, wallets that have large sums, have increased their LTC holdings from 25.8 million to 27.8 million tokens since mid -April, according to Blockchain Santiment data firm.

General description of the technical analysis

The Litecoin price action in the last 24 hours shows a possible bullish reversal, according to the technical analysis data model of Coindesk Research.

Its increase was marked by a pattern of higher and higher minimums, often associated with a growing demand, while a significant commercial activity accompanied each leg. Volume peaks, well above daily averages, suggest a constant institutional interest instead of sporadic retail enthusiasm.

The support arose near the range of $ 86.50, where buyers intervened repeatedly, and the resistance about $ 87.80 was finally broken after an increase concentrated in operations, according to the model.

Three different purchase waves pushed LTC beyond resistance levels. During a burst alone, almost 28,000 tokens changed hands, which helped convert the previous resistance into a new support floor just above $ 88.

The sales pressure decreased after movement.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.