Long-term bitcoin (BTC) holders appear to end their selling spree, a strategy change that has helped turn the psychological resistance price of $100,000 into a support level for the first time.

With one short-lived exception, the largest cryptocurrency has remained above $100,000 since January 17. The past few days have been extremely volatile due to the inauguration of President Donald Trump, which saw an increase in volatility.

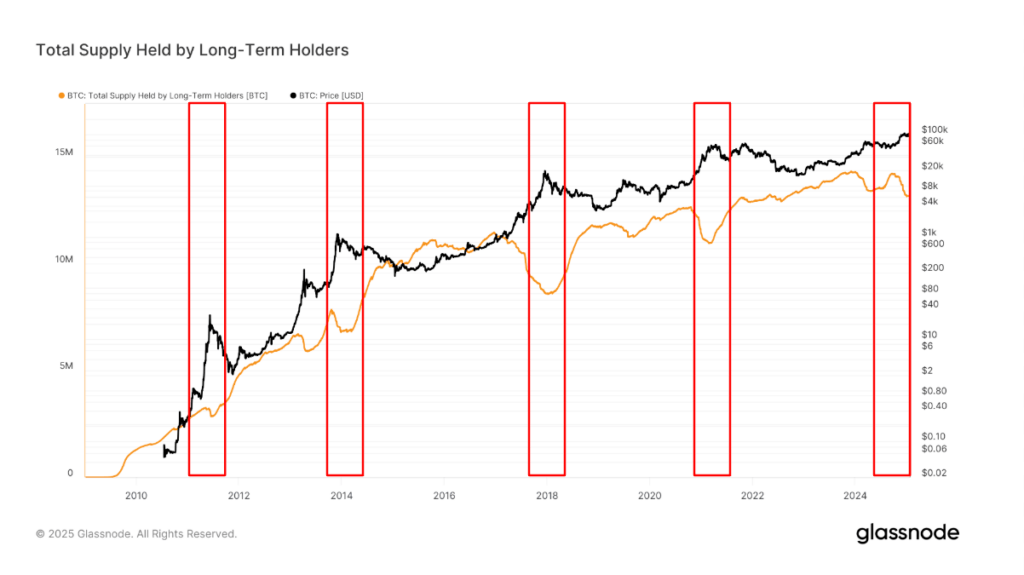

Long-term holders, or investors who have held bitcoin for more than 155 days, have been among those who have contributed the most to selling pressure in the market, according to CoinDesk research from December. They are considered “smart money” because they tend to buy when bitcoin prices are depressed and sell hard, a pattern that has been observed over the past four months.

In September, this cohort held 14.2 million BTC. He now owns 13.1 million BTC. While investors held off at the beginning of the year, sales have risen again in recent days due to rising prices, albeit at a slower pace.

The trend to take into account is when they stop selling. This tends to mark a peak in the cycle, which occurred in 2013, 2017, 2021 and 2024.