According to Glassnode, long -term holders (LTHS) They are defined as investors that have had Bitcoin

For at least 155 days. Coindesk’s research indicates that one of the reasons why Bitcoin has to reach new historical maximums has been selling pressure from these long -term holders.

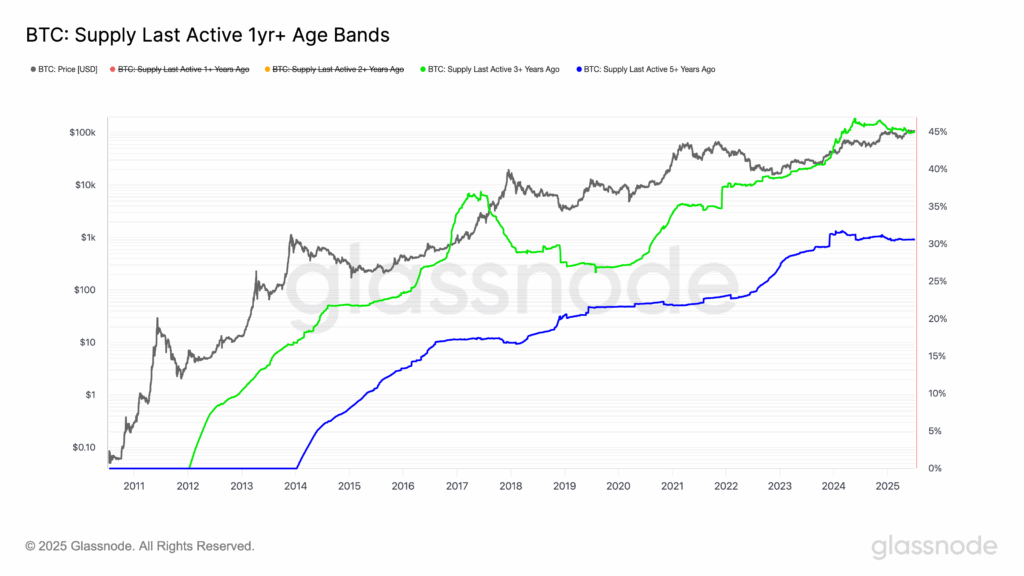

However, Glassnode data approaches Glassnode show that the percentage of Bitcoin circulating supply that has not moved in at least three years is currently 45%, which is the same level observed in February 2024, one month after the launch of the Fund in EE. UU Exchange negotiation.

Three years ago, in July 2022, the market was in the midst of the leverage crisis unleashed by the collapse of 3ac and Celsius during the last Bear market, when Bitcoin had a price of $ 20,000, which shows the condemnation of Lths.

Meanwhile, the participation of circulating supply that has not moved in at least five years is 30% and has remained stable since May 2024.

So, despite the fact that long -term holders are selling, as they usually do when prices rise higher, these data points suggest that the broader cohort has not significantly changed their behavior added for more than a year, which implies that many expect higher prices before making more movements.

Read more: Bitcoin whales wake up from a 14 -year -old dream to move more than $ 2B of BTC