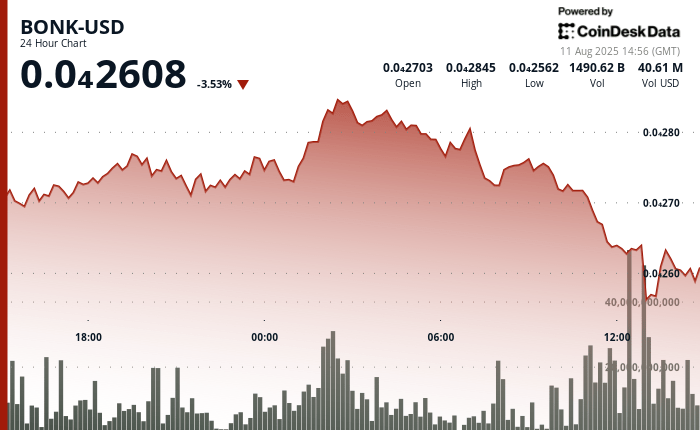

Bonk started the week with a volatile note, with the memecoin -based Memecoin with a maximum of August of $ 0.00002841 before sliding 8%.

The progress marked one of its strongest levels in recent weeks, and found the Swift institutional exchange that erased much of the early profits, according to the technical analysis data model of Coindesk Research.

The sales pressure accelerated between 11:00 and 13:00 UTC, when negotiation volumes increased between 1.12 billion and 2.16 billion tokens. This could have been reduced to coordinated profits, with large holders turning out of the positions. The mass sale reduced 8% to a minimum of $ 0.00002554, a movement that tested key technical support about $ 0.00002620.

The Token saw a brief recovery around 1:00 p.m. UTC after news, a company that quotes in the stock market seemed to be planning to build a Bonk treasure. Safety shot of the health beverage company that is quoted in Nasdaq (SHOT) He agreed to buy $ 25 million in Memecoin in exchange for offering $ 35 million of shares fired to Bonk’s founding taxpayers.

While the resistance to general expenses at $ 0.00002854 remains the main technical barrier, Bonk’s ability to maintain support and recover from heavy sale can provide the basis for renewed upward impulse if a positive feeling of the market continues.

Technical analysis

- Price range: $ 0.00002554 at $ 0.00002841 for 24 hours (12% volatility).

- Resistance: Level of $ 0.00002854 confirmed as a sale zone.

- Support: Critical $ 0.00002620 level maintained during the sale of the sale.

- Volume Pelpas: 1.12–2.16 billion tokens negotiated during liquidation.

- Recovery channel: minimum higher than $ 0.00002565, $ 0.00002572, $ 0.00002570.

- Rupture trigger: $ 0.00002632 level cleared in 49.5b Token arises.

- Trend signal: 8% fall followed by 2% rebound suggests a potential base construction.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.