The financial markets are in a collapse and every lower leg is strengthening expectations in the credit market that the Fed will soon offer support.

Bitcoin (BTC), the leading cryptocurrency for market value, quoted 8% lower than $ 75,800 and US shares were on their way to their worst performance of three days, with s&p 500 futures approximately approximately 5% on Monday alone and the losses that were close to 15% in general.

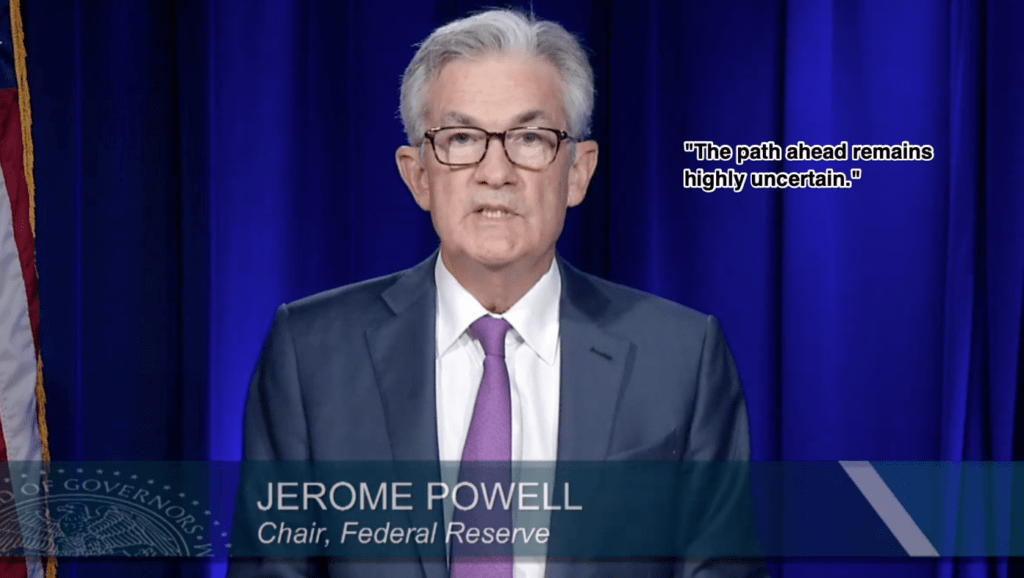

The FED has an intervention history during financial crises with target cuts and other stimulus measures. Then, the merchants, having become accustomed to the liquidity support, are betting that the Fed will act similarly this time.

According to the CME Fedwatch tool, the federal fund futures market now has a price of up to five rate cuts in 2025. For the next meeting of May 7, there is a 61% probability of a cut of 25 basic points, which would reduce the objective range to 4.25 to 4.50%. By the end of the year, the market sees that the FED fund rate falls as low as 3.00-3.25%.

The risk, together with the scare of growth and the fees of reduction of Fed rates, is giving the Trump administration what you want: falling yields of the treasure. The highest 10 years, the reference point for the US economy, has fallen to 3,923%.

The popular narrative is that the lowest yields would facilitate the treasure refinance billions in debt in the next 12 months, so the Trump administration can be more tolerant with the fainting of the asset market.

This urgency of refinancing comes from a policy change under former Treasury Secretary Janet Yellen, who went from the short -term coupon issuance to short -term treasure invoices. Since 2023, approximately two thirds of the deficit had been financed through the issuance of invoices, short -term debt with rates that are around 5%. While this may have temporarily supported the liquidity, it created a short -term expensive debt ticking pump that must now be transferred.