Digital asset treasury Metaplanet (3350) rose 4% in Tokyo on Wednesday after index provider MSCI decided not to exclude companies that create cryptocurrency reserves from its global indices.

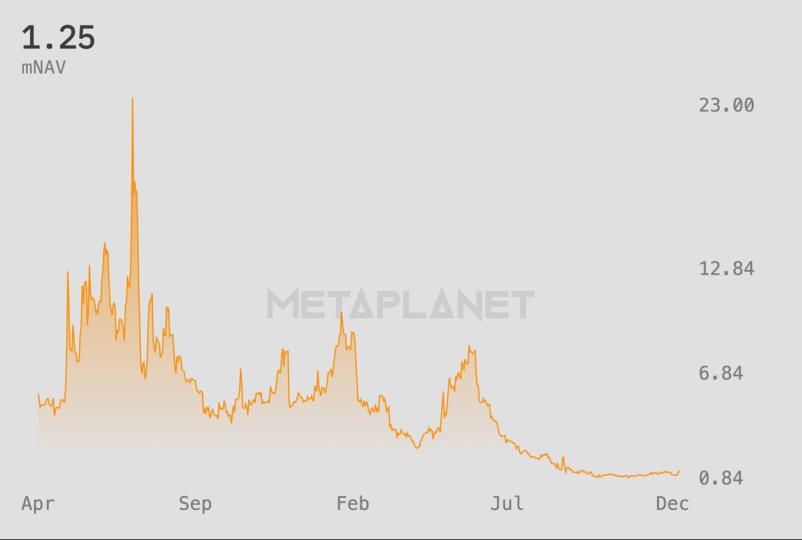

Metaplanet is up 20% since the beginning of the year. The rally means the company is valued at a premium to its bitcoin holdings, with a multiple of net asset value (mNAV) of around 1.25, the highest level since before the crash in cryptocurrency prices in October, according to the company’s dashboard.

The decision ended months of uncertainty over the index’s eligibility and boosted U.S. peers when the announcement was made after regular trading hours on Tuesday. Strategy (MSTR), the largest corporate holder of bitcoin It was recently 5% higher in pre-market trading. Other digital asset treasuries rose to a lesser extent.

Metaplanet shares closed at 531 yen ($3.4), after bottoming near 340 yen on Nov. 18. The company holds 35,102 BTC, making it the fourth publicly traded bitcoin treasury company globally.

MSCI’s announcement eliminates a near-term glut for crypto treasure stocks, particularly those already included in major indices. However, the index provider also noted that a broader consultation on non-operating and investment-oriented companies is coming, indicating that regulatory and index-related risks for bitcoin treasury companies have been deferred, not eliminated.