Discharge of responsibility: The analyst who wrote this article has actions in strategy.

The strategy (MSTR), under the leadership of executive president Michael Saylor, may have finished its largest preferred shares to date with a STRC (stretching) offer that binds to the actions of STRD, Strf and preferred Strk to build the company’s credit yield curve.

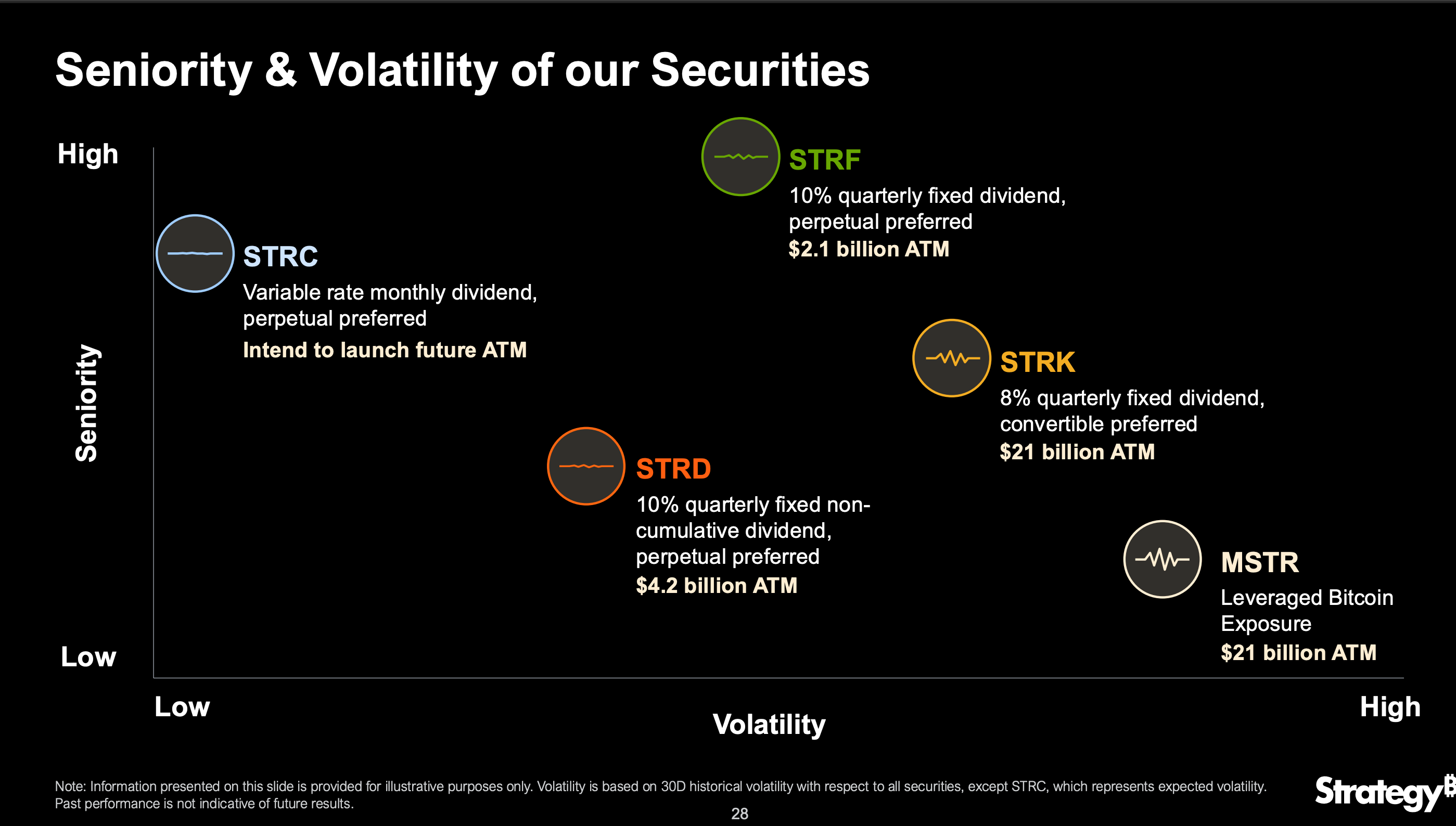

Among these, STRC occupies a high age and low in expected volatility. Add a new short duration layer to the strategy financing mixture and diversify how the company can raise capital for the acquisition of BTC.

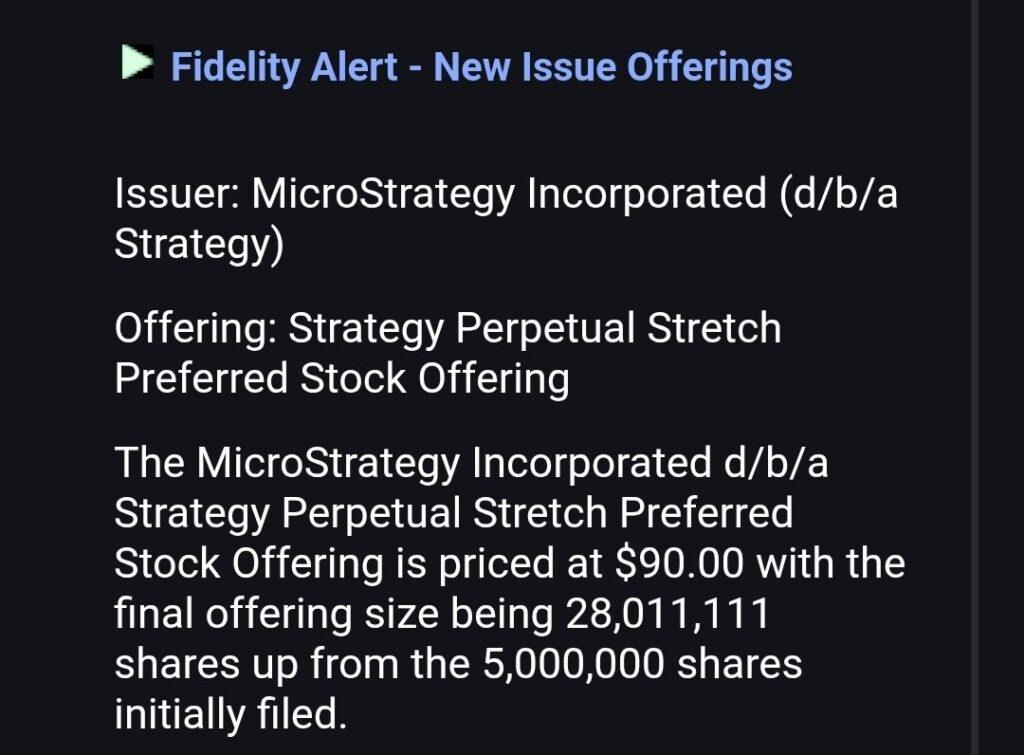

According to a loyalty alert over X, the agreement is 28 million shares with a price of $ 90 each, for a total of more than $ 2.52 billion. This represents a dramatic increase in the original target of $ 500 million announced only a few days before and underlines the continuous ambition of the company to aggressively expand its Bitcoin BTC holdings.

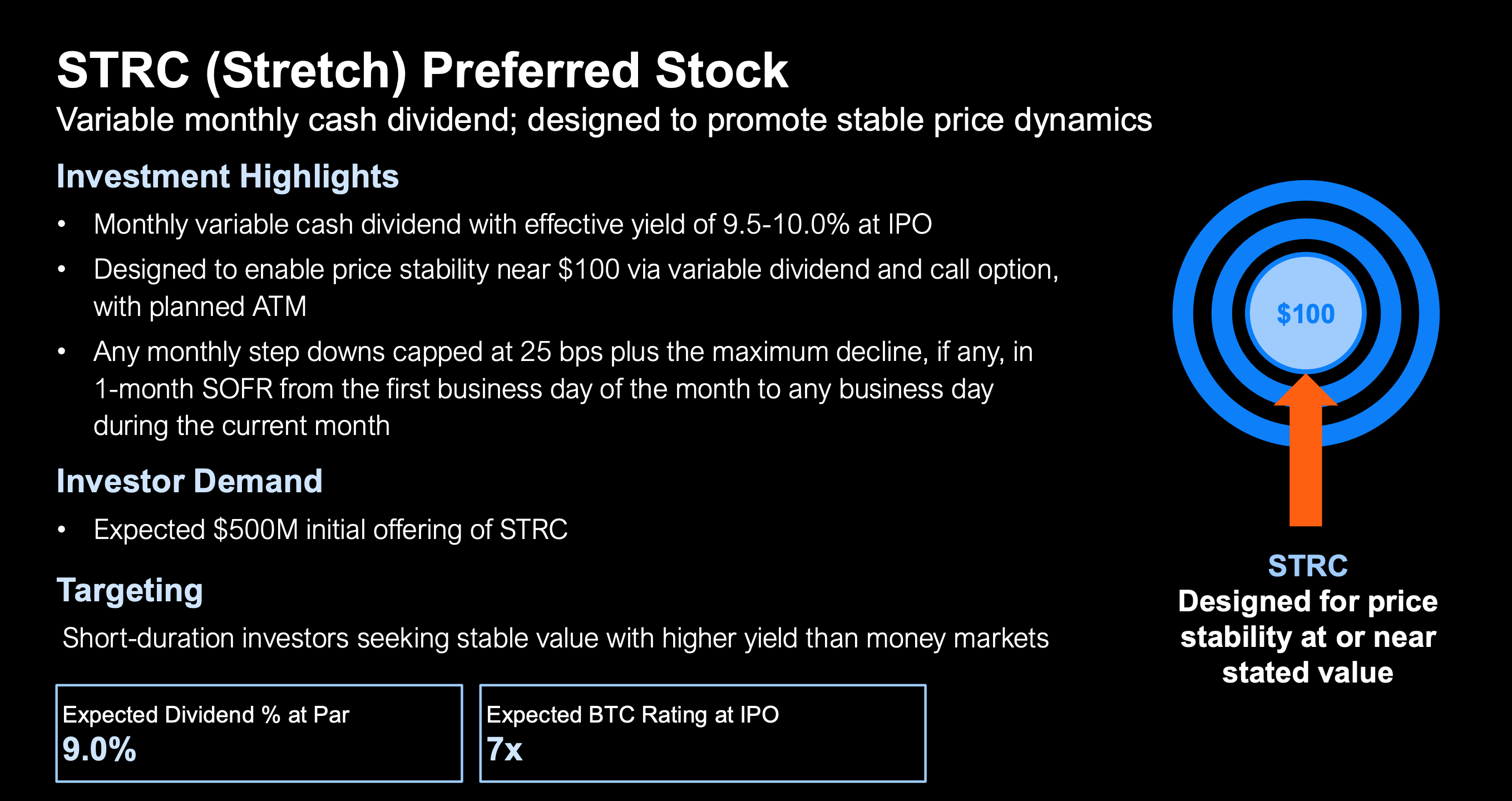

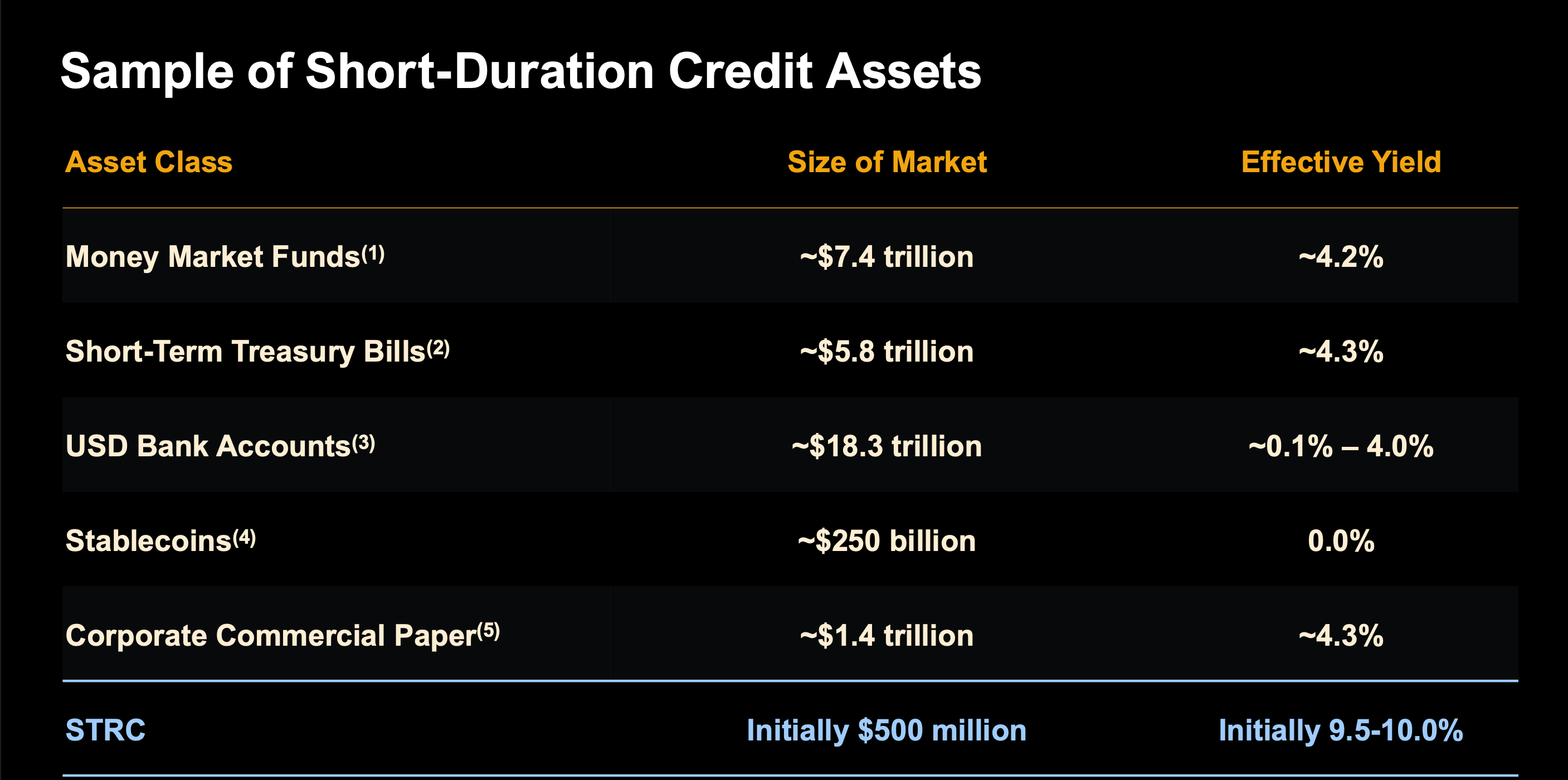

STRC is a perpetual and senior preferred stock that offers a variable monthly dividend designed to attract investors seeking the yield that want stability near the pair value. At the time of the offer, STRC had an effective yield of 9.5% –10.0% paid monthly. It contains mechanisms to maintain a negotiation range close to $ 100, including adjustable dividend rates, secondary emission windows and purchase options above the torque.

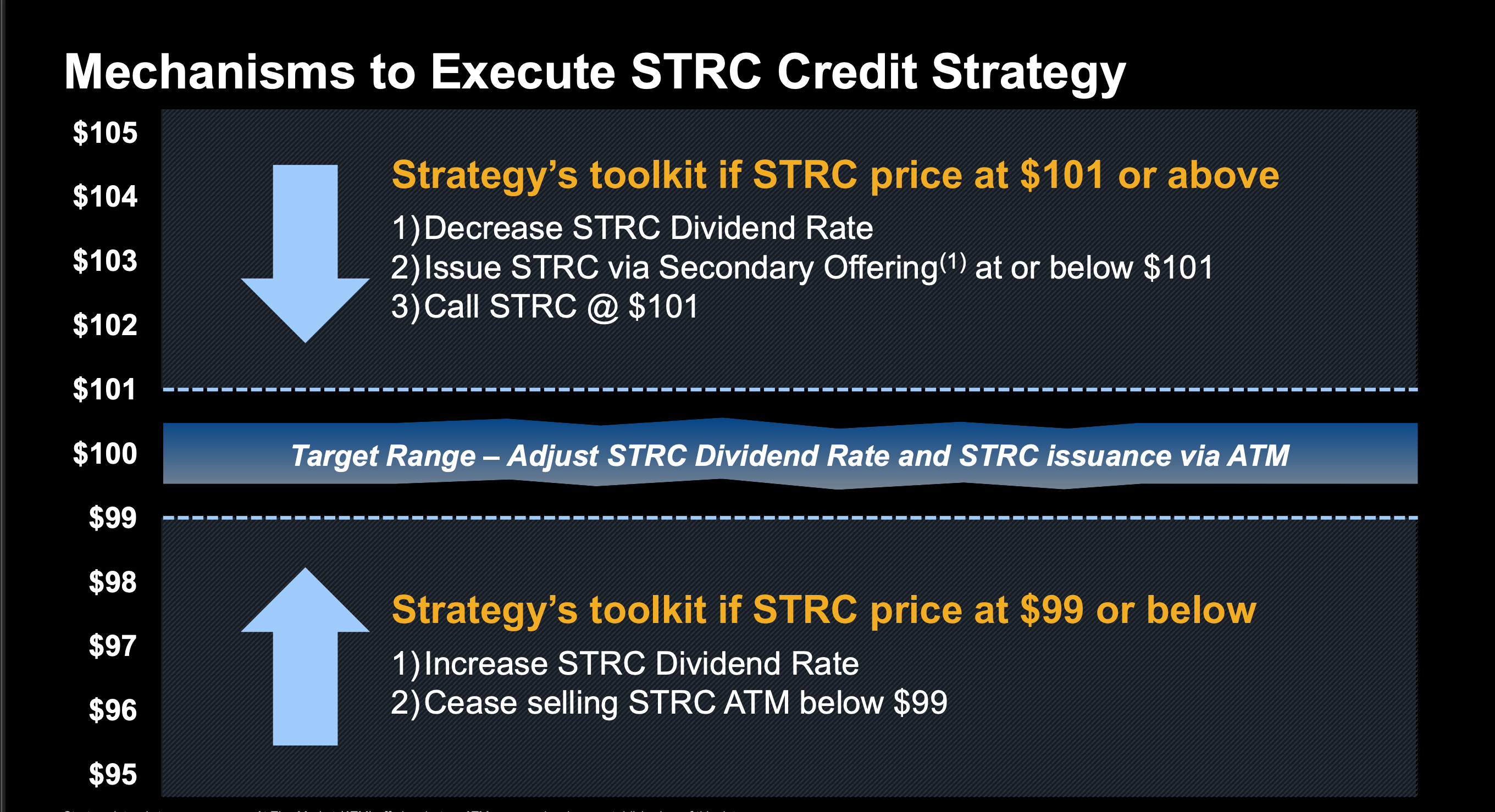

The tools set includes dividends and stop sales when STRC quotes below $ 99, or issuing new shares and calling the shares if it increases above $ 101. These levers are designed to create a self -correction system that promotes market stability while offering attractive yields in the current interest rate environment.

Any reduction in the dividend is limited by 25 basic points plus the maximum decrease in the financing rate during the night of one month during the period.

Compared to conventional short -lived credit options, StRC stands out, offering more than double 4% available for money market funds and treasure invoices. It is aimed at investors seeking greater performance without significant price volatility, positioning it competitively against traditional instruments such as commercial role and bank deposits.