Discharge of responsibility: The analyst who wrote this piece has Strategy actions (MST)

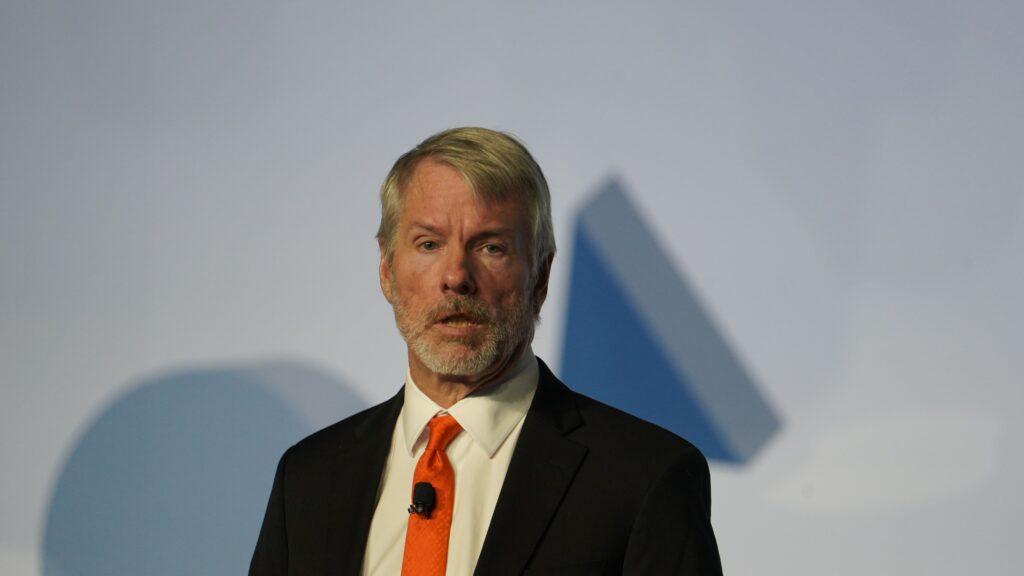

At the Bitcoin Conference in Las Vegas, the Executive President of the Strategy (MSTR), Michael Saylor, was asked how the company would respond if its multiple to net asset value (MNAV) fell below 1, as it did during the previous Bear market.

In response, Saylor drew an analogy with the Bitcoin Trust (GBTC) on the gray scale, stating: “GBTC is a closed confidence … a corporate entity that has no operational flexibility to administer its capital structure.”

He stressed that, unlike GBTC, the strategy is an operational business with the ability to assume the debt and administer its capital dynamically. Saylor argued that “for any company to fall below 1 Mnav, shareholders have lost faith in the business management structure.”

If the actions of the strategy “went to $ 1 tomorrow,” he said, the company would respond selling its favorite shares or fixed income Strk and Strf instruments and use income to repurchase ordinary shares, thus recapitizing the company.

Highlighting the importance of flexibility, Saylor said, “to create value, you must create an option value to generate as optional as possible. The more options the value will be.”

He concluded by stating: “What makes our company a monster is having multiple offers (ATM) in the market (ATM) in multiple capital markets,” underlining the multichannel access of the strategy to liquidity and financial resistance.