Network Chainlink Network Native Token He retired slightly on Friday, establishing a higher minimum, publishing a gain of 6.7% this week. The price action has been supported by a series of news holders on institutions and protocols that take advantage of Chainlink services.

Plasma (XPL) said Friday that it has joined Chainlink Scale, adopting the Chainlink Oracle services for its block chain focused on Stablecoin payments. The Network has the Cross Chain Interoperability Protocol (CCIP) of Chainlink (CCIP), data flows and data feed services, which admits developers to build cases of use of stable in the plasma.

“By adopting the Chainlink standard and joining the Chainlink Scale program, Plasma is demonstrating how the new Layer-1 networks can be launched with the business grade stable infrastructure from the first day,” said Johann Eid, Business Director of Chainlink Labs, the development organization behind Chainlink.

The news follows Swiss Bank UBS that a pilot begins with Chainlink earlier this week, integrating the CCIP protocol with the Swift messenger system for tokenized fund operations.

Meanwhile, the chain reservation, an installation that buys tokens in the open market using income from integrations and protocol services, bought another 46,441 link on Thursday, which leads to the total holdings of 417,000 tokens, for a value of $ 9.5 million.

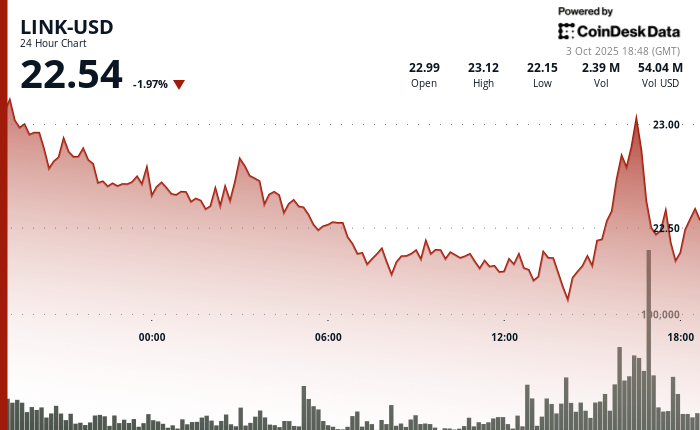

The technical indicators indicate that the optimized impulse is returning for Link, establishing a clear and higher resistance at the $ 23 level, suggested the Coindesk Data research model.

- The link changed the hands within a range of $ 0.96 between $ 22.13 and $ 23.09, which represents a fluctuation of 4.27% during the 24 -hour period.

- Established critical support at $ 22.13 with a substantial purchase interest at a high volume of 1,409,489 units, above the daily average of 1,178,000.

- The Token forged a clear and lower pattern, which suggests a renewed impulse towards the $ 23.10 resistance zone.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.