In 2025, gold has become the leading asset, generating returns of more than 50%, marking one of its strongest performances in more than a decade. The precious metal became the clear winner of what leading commentators called the “debasement trade”, a viral term that captured growing investor anxiety over global debt levels, over-borrowing and the weakening US dollar, which suffered its worst year in many. In October, gold’s rally reached record levels, coinciding with a high of almost $4,400 per ounce, now stabilizing around the $4,000 per ounce level.

This feature is part of CoinDesk List of the most influential of 2025.

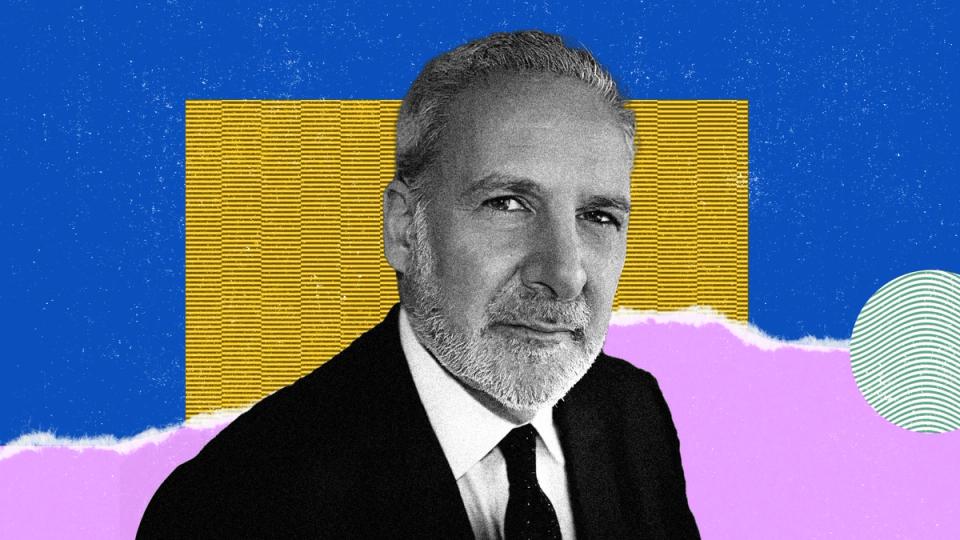

This environment validated long-standing warnings about monetary debasement, a concern often expressed by the bitcoin community. Ironically, however, it was gold, not bitcoin, that captured investors’ attention and capital this year. So far, gold has generated an 8x return than bitcoin in 2025. Peter Schiff, the outspoken gold advocate and notorious bitcoin critic, has been vindicated by the market’s performance, cementing his stance after years of skepticism toward digital assets.

While Schiff continues to defend gold’s role as the ultimate store of value, the broader market narrative has evolved between traditional safe havens and digital alternatives.