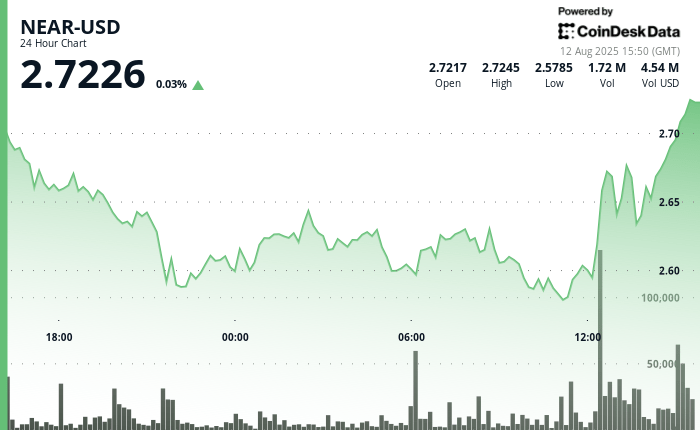

Near the protocol saw acute intradic swings on August 12, with prices rising from $ 2,643 to $ 2,678 for 13:35 before quickly reverting. The mass sale, concentrated between 13:38 and 13:49, deleted most of the earnings per hour as the Token fell to $ 2,634 in a heavy volume greater than 200,000 tokens per minute. The profits at the resistance level of $ 2,675– $ 2,680, identified in previous sessions, cut the rally, while the $ 2,630 area– $ 2,635 once again provided firm support. Near the time at $ 2,644 after an attempt at low volume.

During the previous 24 hours, it almost recovered from support of $ 2.57 to play $ 2.73, a 6% range that showed aggressive purchase interests. The measure followed an initial drop from $ 2.68 to $ 2.58 before buyers recovered control, sending prices to $ 2.68 with an exceptional turnover of 8.01 million tokens. The resistance around $ 2.68– $ 2.73 remains intact, with $ 2.57– $ 2.59 that demonstrates a reliable floor during repeated tests.

The institutional demand supported the demonstration, with $ 572 million in global tickets in investment products of digital assets last week, including $ 10.1 million directed towards Near. The impulse occurred when policy changes in the United States allowed digital assets in 401(K) Retirement plans, causing $ 1.57 billion in entries from the end of the week and increasing confidence in Blockchain markets. Analysts see this as a crucial moment for conventional adoption, potentially expanding the Near investor base.

Technically, Near’s chart shows a resistant recovery pattern backed by high volume over -volume over -level levels. Strong purchases about $ 2.57– $ 2.59 caused acute reversals repeatedly, while the upper band of $ 2.68– $ 2.73 continues to attract strong sales pressure. With the institutional flows that accelerate and regulatory developments that favor the adoption of cryptography, Near’s price action can remain volatile but backed by strengthening long -term support.

Technical indicators

- The high volume increase that exceeds the average of 24 hours of 2.73 million establishes a formidable resistance around $ 2.68- $ 2.73.

- The $ 2.57- $ 2.59 area has proven remarkably robust as support through multiple successful exams and reversals backed by volume.

- The most significant bearish pressure was materialized between 13:38 and 13:49, in which nearly $ 2.67 to $ 2.63 collapsed, effectively erasing virtually all the earnings per hour within a time frame of 11 minutes accompanied by an exceptionally high sales volume that exceeds the tokens of 200,000 per minute.

- This volatile configuration suggests obtaining activities in the resistance zone of $ 2.68- $ 2.68 established during the 24-hour background analysis.

- The level of $ 2.63- $ 2.64 continues to provide a critical support, and the session concludes at $ 2.64 after a modest attempt of recovery that lacked a sentence for sufficient volume.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.