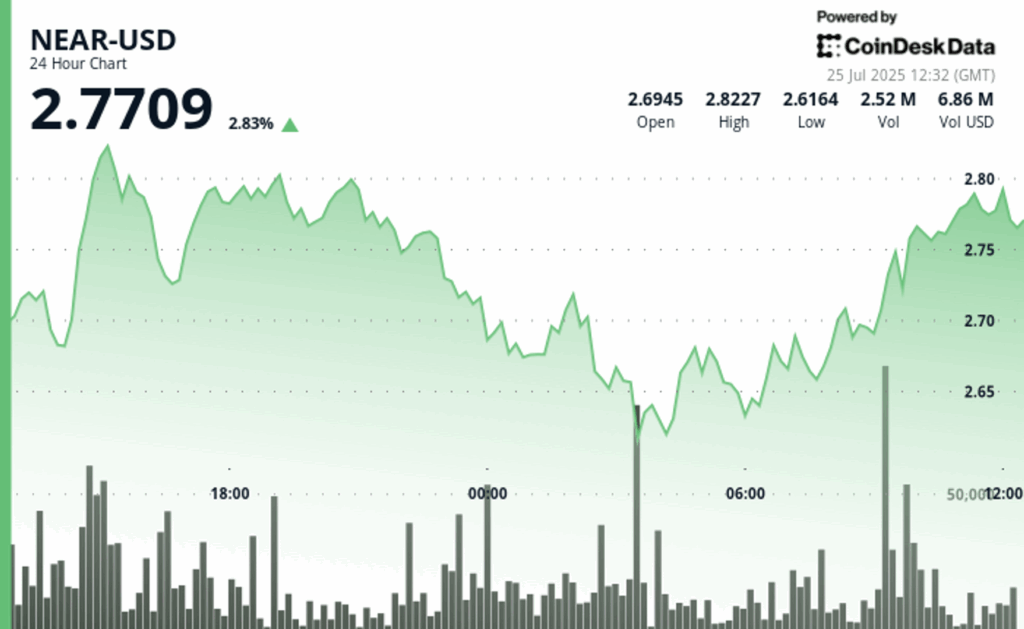

Near the protocol bounced 0.7% between 11:10 and 12:09 UTC on Thursday, erasing a brief drop of $ 2.77 in a volatile negotiation window marked by sudden institutional tickets. The Token caused $ 2.79 to $ 2.77 before recovering the maximum sessions, highlighting a two -phase movement characterized by consolidation about $ 2.78, followed by a sale and quick sales recovery.

The rebound was activated by an acute increase in volume, with more than 123,000 negotiated units after 12:01, breaking the levels of resistance and the accumulation of signaling potential by large players. The movement limited a wider 6.9% rally of $ 2.61 of support during the night to a closure of $ 2.79 during the negotiation window from July 24 to 24, fueled by greater volatility and a revived bullish feeling.

Analysts see the increase as a potential configuration for a resistance level proof of $ 2.83, with longer -term projections that are placed near a range of $ 1.95– $ 9.00 by 2025 and as high as $ 71.78 by 2030. The continuous development of the cross -chain excursion with Solana and Ton is cited as a catalyst for institutional interest and expansion of potential prices.

The bullish impulse of the technical rupture is indicated

- $ 0.22 The negotiation range represents 8.50% of volatility between $ 2.83 maximum and $ 2.61 minimum during the 23 -hour period.

- The strong support level of $ 2.61 confirmed with a volume of more than 3.18 million daily average.

- Recovery moment of $ 2.69 to $ 2.79 closing objectives of $ 2.83.

- The consolidation of $ 2.78 precedes the acute support test of $ 2.77 during the volatility of the average session.

- The exceptional volume of more than 123,000 units during the over -time of the final hour confirms the institutional accumulation phase.

- Multiple broken resistance levels during recovery establishing new session maximums of $ 2.79.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.