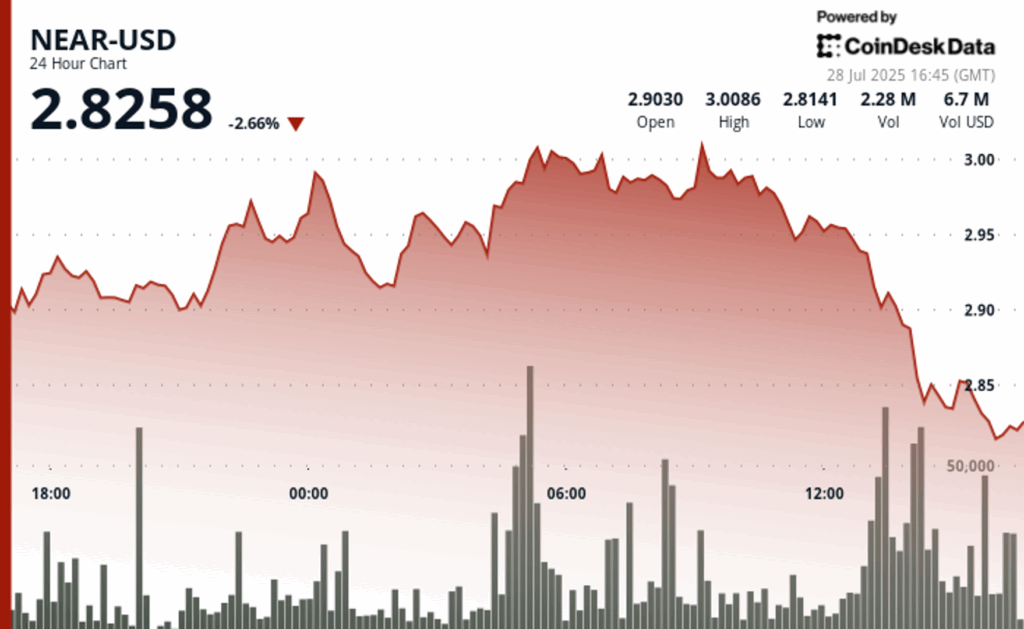

The ear protocol saw a volatility pronounced during the 24 -hour period from July 27 at 3:00 p.m. to July 28 at 2:00 p.m. UTC, fluctuating within a range of 5% between $ 2.88 and $ 3.01. The Token initially recovered from $ 2.90 to a maximum of $ 3.0 at 09:00 UTC on July 28, finding the company’s resistance at that level. The price action was marked by a strong upward boost until an institutional sales pressure, indicated by an increase in the volume of negotiation to 3.10 million, well above the average of 24 hours of 2.35 million arose.

This bullish race was short -lived, since it almost invest abruptly during the negotiation time of 13:00 UTC, falling from $ 2.94 to $ 2.89 in the middle of an amazing negotiation volume of 5.03 million. The magnitude of this mass sale, more than double the daily average, points to a possible institutional distribution and a change marked in the feeling of the market in the short term. The subsequent 60 -minute window saw a continuation of this downward trend, with the token falling from $ 2.93 to $ 2.89, forming a clear descending channel between $ 2.93 resistance and support of $ 2.88.

Multiple high volume sales during the last hour, especially at 13:21, 13:32 and 14:04 UTC, suggest a persistent bearish impulse. Commercial activity fell sharply in the final minutes, hinting at the exhaustion of the market in the short term and the possible lateral consolidation close to the level of $ 2.89. With an almost seated form at the lower end of their intra -rank, merchants can search broader macro signals before determining the next movement.

The direction of nearby and other alternatives may depend on whether Bitcoin can break over the psychological level of resistance of $ 124,000 and enter a consolidation phase. A successful BTC rupture could trigger a capital rotation in Altcoins, preparing the stage for a renewed impulse up in assets such as Near.

Technical Analysis Summary

- Firmly established resistance to $ 3.0, which triggers strong sales pressure.

- Initial ascent marked by volumes that exceed the average of 24 hours of 2.35 million.

- Inverse Sharp from $ 2.94 to $ 2.89 with increase volume to 5.03 million, more than double the average.

- The descending trend channel formed between $ 2.93 resistance and support of $ 2.88.

- Multiple intra-horas volume (200k+) aligned with strong price rejections.

- The final minutes saw an insignificant volume, which indicates a possible exhaustion of the market about $ 2.89.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.