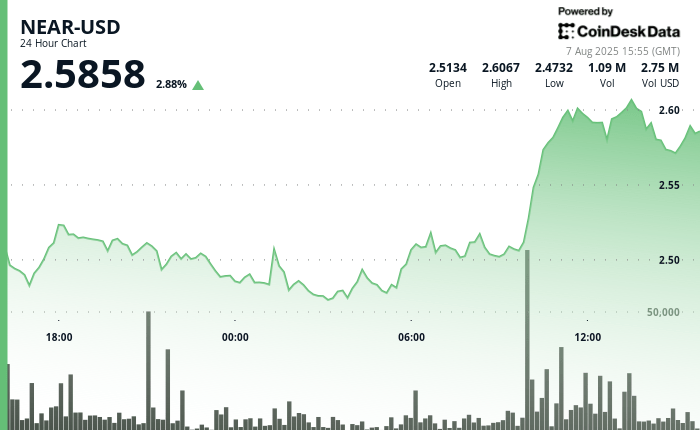

Near the protocol rose 5% of $ 2.47 to $ 2.60 in the 24 -hour period that ended on August 7 at 2:00 p.m. UTC, exhibiting strong resistance in the midst of a broader market turbulence. The institutional accumulation helped feed a recovery rally after the minimums of the early session, with a price share that merged between $ 2.48 and $ 2.52 before a strong rings around 10:00 UTC, backed by 3.36 million in negotiation volume. The advance of the asset, partially influenced by the feeling of global risk, reflected the turn of investors to alternative assets during the greatest geopolitical and macroeconomic uncertainty.

Tapa uprising moment for sale of the late session

Despite its previous force, the last hour of commerce closely, from 13:06 to 14:05 UTC, was an increase in volatility that deleted most of the intradic gains. After briefly testing the resistance to $ 2.61, an increase in the volume between 13:39 and 13:42 coincided with a profit taking. The sale of the pressure shaped a descending channel, with a price in withdrawal to close at $ 2.60, slightly above a new support about $ 2,598. The movement indicates possible short -term exhaustion, since the institutional distribution may be limiting more upward despite the previous accumulation.

Macro conditions continue to shape market dynamics

The backdrop of Near’s performance is still strongly influenced by changing macroeconomic forces. As the main economies emphasize monetary policy in response to the inflationary effects of current commercial disputes, institutional flows to digital assets such as Near have intensified. The intrainamic decline of cryptocurrency reflects the broader market doubt of the market, as the participants digest global policy changes and their implications for the structure of the cryptographic market and the appetite of risk.

Analysis of technical indicators

- The near protocol demonstrated considerable resistance during the previous period of 24 hours from August 6 from 3:00 a.m. to 7:00 p.m., recovering from the first Nadirs of the $ 2.47 session to close at $ 2.60, which represents a convincing profit of 5%.

- The cryptocurrency exhibited a pattern of classical accumulation throughout the initial 18 hours, consolidating between $ 2.47- $ 2.52 before increasing dramatically at 10:00 on August 7 with an exceptional volume of 3.36 million units, which opens triples the average of 24 hours of 1.20 million.

- This rupture established a robust support at $ 2.51 and compensated resistance to $ 2.61, with the pronounced price expansion that suggests an institutional accumulation followed by purchases driven by the impulse that could be extended to $ 2.65- $ 2.70 depending on the projections of measured movements.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.