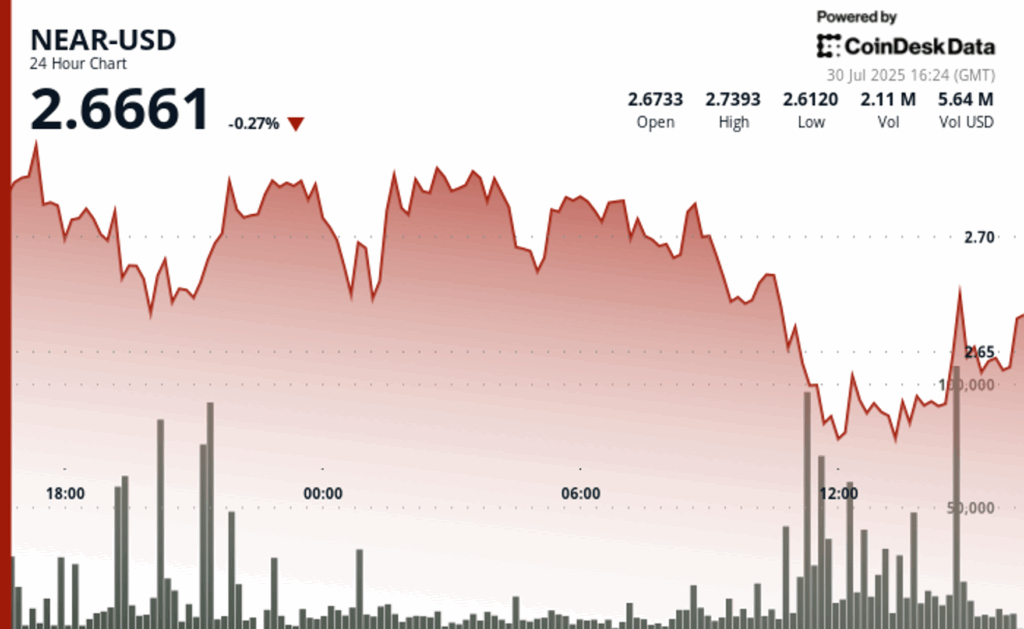

The nearby protocol (near) organized a modest intradic recovery during the last 60 minutes of negotiation on July 30, advancing from $ 2.62 to a $ 2.63 session before resolving $ 2.62.

While the movement may seem marginal, it was developed in a context of persistent pressure down, which reflects a strip and loosening between the fresh defi impulse and the winds against the market.

A remarkable increase in negotiation volume, the sale of 219,646 units at 13:57 UTC, was removed as a possible sign of institutional interest to lower valuations, despite the broader prices contraction during the day.

The increase coincided with the official commercial debut of Rhea Finance in Lbank Exchange at 2:00 p.m. UTC. Rhea, a unified defi platform that combines almost native Finance and Burrow protocols, enters the market backed by $ 4.5 million in Jump Crypto and Dragonfly capital funds.

The moment of its launch may have stimulated speculative positioning or short -term accumulation, although its impact was insufficient to reverse the losses intradic completely. Nearly closed the 24 -hour window dropped almost 3%, sliding from $ 2.70 to $ 2.63 in sustained resistance in the $ 2.73– $ 2.74 area.

The close path is still emblematic of the current enigma of the market: the expansion and innovation of the ecosystem protocol are proceeding, but Token prices continue to reflect caution. The convergence of the definition of defense through Rhea’s innovation and layer 2 through Wewake places near the center of infrastructure evolution, but until key resistance levels are infringed and maintained, the Token seems trapped in consolidation mode.

Technical analysis

- 24 -hour price movement: Below 3% of $ 2.70 to $ 2.63

- Resistance zone: $ 2.73– $ 2.74, repeatedly rejected during high volume periods

- Support level: $ 2.63 under test; Failure can be opened down to $ 2.61

- Key volume peak: 219,646 units at 13:57 UTC, almost 4x average per hour

- Price range: $ 0.14 Swing Intraday (5.1% of the peak), from $ 2.74 to $ 2.61

- Market structure: High volume rejection in the resistance, consolidation near the support in the middle of the peel of bearish background

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.