Islamabad:

Pakistan has again requested China to reschedule a debt of $ 3.4 billion for two years to close a foreign financing gap identified by the International Monetary Fund, in a movement that its success will largely address external financing concerns before The next program review conversations.

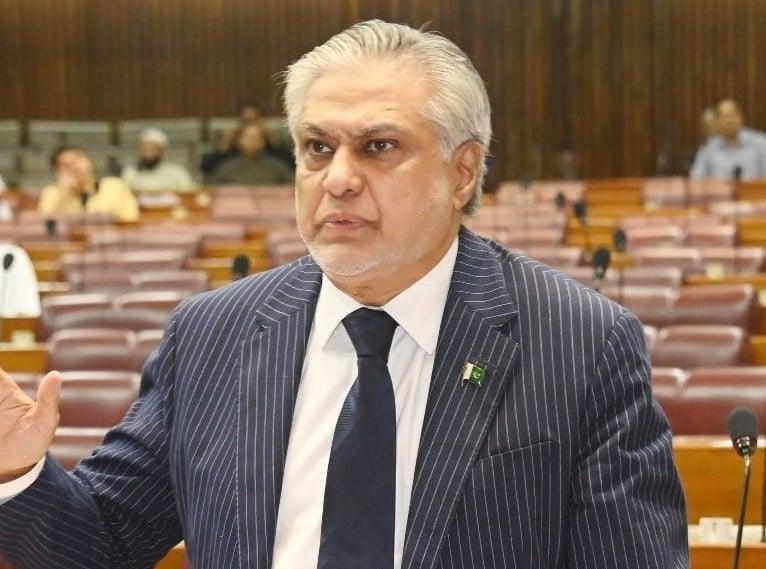

The Vice Prime Minister Ishaq Dar made the formal request during this week to Beijing, according to government sources. They said that the Chinese authorities were positive and, hopefully, Beijing would accept the request to reduce the external financing problems of Pakistan.

Pakistan asked China’s Export Bank (exim) to consider the reorganization of its loans that expire from October 2024 to September 2027, government officials said. They said that Pakistan should identify financing sources to fill the external financing gap of $ 5 billion for the three -year program period.

It is the second time that Pakistan asks China in the last five months to reschedule the debt of $ 3.4 billion provided by its Exim bank. Previously, in September last year, the Minister of Finance had written to the exim bank and requested the reprogramming.

According to a joint statement by China-Pakistan issued on Thursday, the Pakistani side reiterated its high appreciation for China’s valuable support for Pakistan’s fiscal and financial stability. The statement was issued at the end of President Asif’s state visit to Beijing.

The $ 3.4 billion debt was maturing between October 2024 and September 2027, which coincided with the three -year period of the IMF program. The bank has granted two types of loans: direct loans and guaranteed loans to state companies, the sources said.

It is said that reprogramming is critical for Pakistan and is part of the General External Financing Plan of $ 5 billion that Pakistan has to implement to close the gap, identified by the IMF at the time of signing the rescue package in September of the last year.

Pakistan has sought a two -year extension in the reimbursement of the official and guaranteed debt obtained from the Chinese Export Export Bank (EXIM). The country would continue to pay interest.

From October 2024 to September 2025, direct exim loans of $ 505 million for the government would mature, the period that will cover the first two reviews of the IMF program. Then, from October 2025 to September 2027, other direct loans of $ 1.7 billion for the government would mature. This brings total direct loans that require an extension of two years to $ 2.2 billion.

Loans of $ 1.2 billion from China to SOES are also maturing from October 2024 to September 2027 and most of them are maturing from October of this year.

In July 2023, the then Minister of Finance and now Vice Prime Minister Ishaq Dar had announced the $ 2.43 billion worth 31 loans rescheduled by China for two years. Giving had said that the Exim Chinese bank had realized for two years of main loan amounts for a total of $ 2.4 billion, which had to be presented from July 2023 to June 2025. Pakistan was only making interest payments with the Reprogrammed debt of $ 2.4 billion.

In case Pakistan does not reimburse the debt of $ 3.4 billion, its external financing gap would be reduced by the same amount. The government this week also obtained a Saudi oil installation of $ 1.2 billion and received a loan of $ 300 million through United Bank Limited to close the general financing gap.

The Pakistani authorities have already held at least a couple of meetings on the issue of debt restructuring of $ 3.4 billion and exchanged the data with the Exim bank.

It is expected that the first formal review of Pakistan of the $ 7 billion program begins from the first week of March and its successful conclusion will pave the way for the launch of the section of loans of more than $ 1 billion.

Pakistan depends largely on Beijing to remain afloat, the friendly nation that constantly passes on cash deposits of $ 4 billion, $ 6.5 billion worth commercial loans and a commercial financing installation of $ 4.3 billion.

Fitch Ratings, one of the three world agencies of credit qualification, said Friday to ensure sufficient external financing remains a challenge for Pakistan, considering large maturities and existing exhibitions of the lenders.

He added that Pakistan budgeted around $ 6 billion of multilateral funds, including the IMF, for this fiscal year, but around $ 4 billion of this will effectively refinance the existing debt.

The request of $ 3.4 billion adds to a new loan of $ 1.4 billion that the Minister of Finance, Muhammad Aurengzeb, requested during his interaction with the Minister of Finance of China’s vice president in Washington.

Aurengzeb had asked China to raise the limits under the currency exchange agreement to CNY 40 billion. Pakistan has already used the CNY CNY 30 billion, or $ 4.3 billion, the Chinese shopping center to pay its debts and now seeks to increase this limit by an additional CNY 10 billion, translating to $ 1.4 billion at the current current exchange rate .

It is not clear if China has entertained the new request of $ 1.4 billion or not.

Fitch declared that Pakistan has continued advancing in the restoration of economic stability and the reconstruction of external shock absorbers. But progress in difficult structural reforms will be key to the next reviews of the IMF program and the continuous financing of other multilateral and bilateral lenders.

He predicted that foreign reserves are configured to overcome the objectives under the IMF program and previous Fitch forecasts.

But currency reserves remain low in relation to financing needs. More than $ 22 billion of public external debt mature in this fiscal year, including almost $ 13 billion in bilateral deposits, Fitch said. It was believed that bilateral partners will restart, according to their promises to the IMF. Saudi Arabia already rolled more than $ 3 billion in December and the US $ 2 billion in January.