Bitcoin

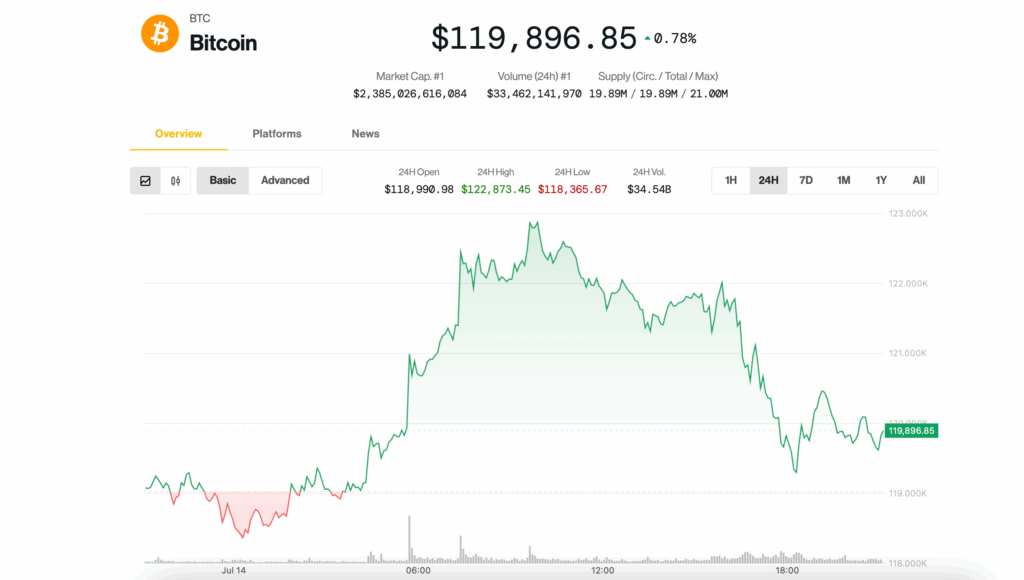

He cooled during the negotiation hours of the United States on Monday after almost exceeding $ 123,000 before the session, but market calls are premature, analysts said.

BTC fell below $ 120,000 at the end of the US Day., Drawing most of its progress during the night, but remained in a modest gain of 0.6% in the last 24 hours. Ethereum’s Ether Eth He slid below $ 3,000, while Dogecoin

Cardano Ada Ada and Stellar XLM XLM decreased around 2% -3% in the day.

Between Majors, XRP

Sui and unisswap’s uni UNI surpassed with profits of 2.5%, 10%and 6%, respectively.

Existence linked to cryptography also returned on some of their morning profits, with strategy (Mstr) and galaxy (GLXY) even greater 3%-4%, while coinbase (COIN) won 1.5%

After BTC increased more than 10% in less than a week and some altcoins that advance much more, prices can consolidate as some merchants digest the movement and get profits.

Even so, this stage of the cryptographic rally is more likely in the early stages than towards the end, said Jeff Dorman, CIO of the Ark digital asset investment firm.

In an investor note on Monday, he cited the observation of Crity Analyst Will Clemente on the main previous superiors such as the Pico related to the Bitcoin ETF of March 2024 and the frenzy of December 2024/January 2025 that surrounds the Trump’s elections/inauguration, when the interest opened in the Derivatives of Altco BTC

“The current rally is not close to that,” Dorman said.

The volumes in centralized and decentralized exchanges increased 23% week after week, but they are not yet close to the levels during other wide market manifestations in the past, Dorman added.

When observing the general panorama, Bitcoin is being promoted by an excessive sovereign debt and investors seeking a shelter of monetary inflation, said Eric Demuth, CEO of Crypto Exchange Bitpanda, based in Europe.

He said BTC increased to € 200,000 ($ 233,000)It is “certainly a possibility”, but the underlying adoption of the asset is more important than the price objectives.

“What happens when Bitcoin is permanently integrated into the portfolios of the main investors, in the reserves of the sovereign states and in the infrastructure of global banks?” He said. “Because that is exactly what is happening right now.”

In the coming years, Dermuth expects Bitcoin market capitalization to gradually convert Gold’s, it is currently in more than $ 22 billion, nine times larger than BTC.