On June 11, PayPal announced plans to launch its stablcoin backed by US dollar, Paypal USD (Pyusd)on the stellar blockchain network, waiting for the regulatory approval of the Department of Financial Services of the State of New York. If approved, the movement would mark the expansion of Pyusd beyond its current availability in Ethereum and Solana.

PayPal described Stellar as a block chain adapted for low -cost and high speed payments with a strong utility of the real world. By adding support to Stellar, the company aims to improve the accessibility and usability of Pyusd for payments, cross -border transfers and financial services. Integration is expected to improve daily payment options and provide users to expand access to financing tools, such as working capital and loans for small businesses, the areas where Stellar is already active.

The press release emphasized the existing global infrastructure of Stellar, including a wide network of ramp ramps, local payment systems and digital wallets, which could help Pyusd take users to users in more than 170 countries. PayPal also highlighted the potential benefits of liquidity and liquidation through PayFI, an emerging digital financing mechanism that would allow companies to access real -time capital disbursed in Pyusd in Stellar.

May Zabaneh, vice president of PayPal digital currencies, said society would help advance blockchain in cross -border payments. Denelle Dixon, executive director of the Stellar Development Foundation, said that collaboration could help provide practical use of Stablecoin to emerging markets and small businesses worldwide.

Pyusd is issued by Paxos Trust Company and is totally supported by equivalent reserves in cash and effective, with a fixed redemption value of $ 1.00 per Token.

Previously, in a brief video published by the Stellar Foundation, Ian Burrill, senior director of PayPal, which manages the cryptographic engineering team, explained why his company was excited about the launch of Pyusd in Stellar. Burrill said Stellar is a quick and low -cost network and extends Pyusd’s reach to more than 180 countries. He continued saying that allowing merchants to use Pyusd in Stellar allow them to send money in real time, which makes more efficient capital management.

Technical analysis

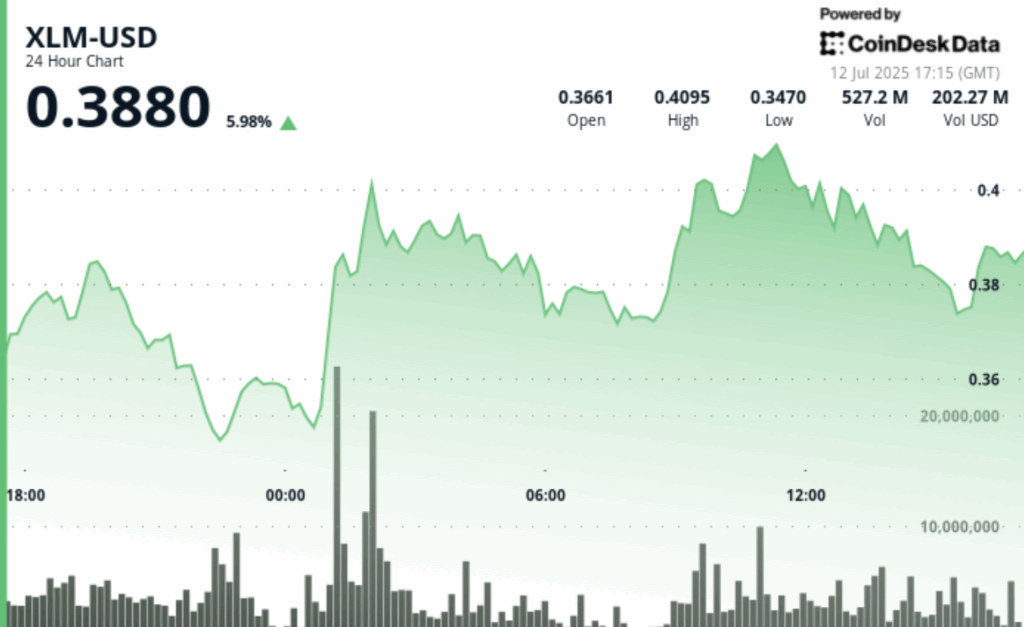

- Stellar’s Token XLM recorded a significant pricing during a 24 -hour negotiation period from July 11 at 5:00 p.m. UTC until July 12 at 4:00 p.m. UTC, with shares that move within a range of $ 0.071 that represents the volatility of approximately 20.59% between a minimum session of $ 0.345 and higher of $ 0.416, according to the technical analysis model Research

- The most notable commercial activity occurred during the early morning of July 12 at 01:00, UTC, when XLM shares advanced from $ 0.354 to $ 0.393 in a substantial volume of 551.38 million units, significantly exceeding the average of 24 hours of 234.19 million and establishing technical support near the price level of $ 0.354.

- The ascending impulse persisted until July 12 at 11:00 UTC, reaching a maximum of a $ 0.416 session, before finding resistance in the range of $ 0.400- $ 0.403 where the institutional gain took more progress seemed to limit more advances.

- In the last hour of negotiation from July 12 at 3:47 p.m. UTC to 4:46 PM UTC, XLM demonstrated a renewed force with a 3.89% advance from $ 0.37 to $ 0.39, extending the positive impulse of the session.

- The most significant price movement occurred between 16: 03-16: 08 UTC when the shares rose from $ 0.374 to $ 0.385 in a high volume of 13.16 million and 17.14 million respectively, well above the average per hour of 3.2 million units.

- This activity established a technical support of around $ 0.385- $ 0.387, where the shares were consolidated through the last 30 minutes of the session, with the market participants who consider a continuous potential towards the resistance levels of $ 0.39- $ 0.40 identified in a broader technical analysis.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.