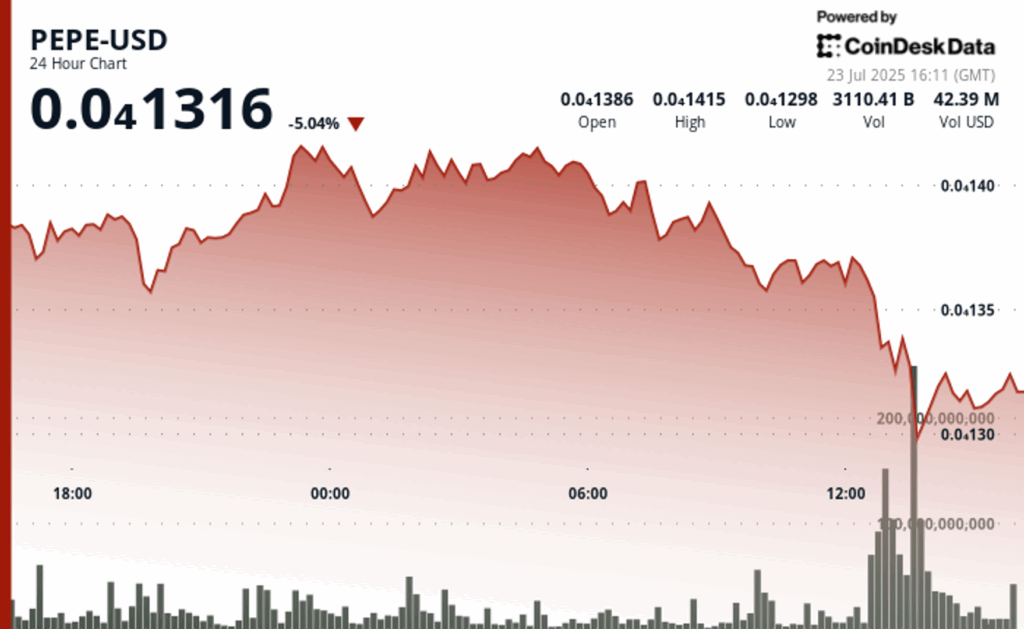

Pepe fell more than 5% in the last 24 -hour period, falling from a higher session about $ 0.000014167 to a minimum of $ 0.000012915, before seeing a slight recovery.

The negotiation volume reached 13.02 billion tokens per hour during the mass sale, more than four times the average of the 3.2 billion session, according to the technical analysis data model of Coindesk Research.

Despite the sale of the sale, several market indicators suggest a deeper interest of investors. Google’s search consultations for Pepe jumped on July 22, reaching its maximum point shortly before the block, according to Google Trends.

Meanwhile, whale wallet properties in Ethereum, measured by the 100 main directions, grew 3.2% in the last 30 days. Pepe tokens in exchanges fell by 2.5% during the same period, according to Nansen data, suggesting that there is less available supply.

At the end of the session, Pepe had recovered some of his losses, stabilizing around $ 0.0000131. The recovery volume remained high, averaging between 300 and 400 billion tokens per hour, showing a renewed purchase interest after the reduction.

General description of the technical analysis

The price action during the session was defined by strong changes and clear levels of resistance and support. Pepe constantly failed to break the range of $ 0.000014150, forming a roof that rejected buyers several times.

On the negative side, the $ 0.000013 mark acted as a floor where prices recovered repeatedly.

The most intense sale occurred when the volume per hour shot, which suggests forced outputs and large -scale earnings. But by closed session, a constant activity on the purchase side, with an average of 300 to 400 billion tokens per hour, hinted at a possible rebound.

While the rally lost steam, the underlying commercial behavior reflects a family pattern in memecor markets: exaggeration overcomes followed by acute corrections, with long -term holders that seize volatility as an entry point.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.