The cryptocurrency inspired by Meme Pepe lost almost 4% of its value in the last 24 hours in the middle of a broader market sale that affects most cryptocurrencies.

The former Bitmex CEO, Arthur Hayes, sold its position of $ 414,000 in the Memecoin, citing the macroeconomic risk on the potential impact of US rates in the third quarter of the year. Hayes’s sale also included other Altcoin holdings while accumulating Stablecoins.

Hayes pointed out to weaken the economic conditions of the United States and a new tariff policy that takes effect on August 7, which will apply levies of up to 41% in imports from more than 90 countries.

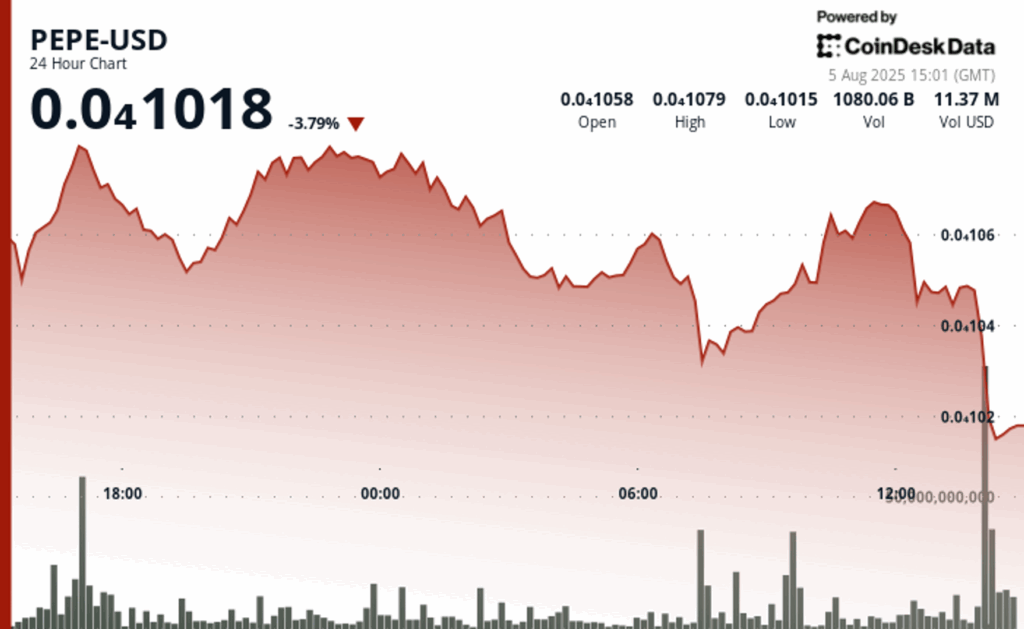

Politics has sent nerves through the cryptographic market, affecting speculative assets such as memecoins. Pepe’s price fell a maximum of $ 0.00001083 to a minimum of $ 0.00001002, with a total of 3.26 billion tokens changing their hands during the recession, according to the technical analysis data model of Coindesk Research.

This volume peak suggests capitulation by some merchants. The Token finally settled near his low session, where he is currently quoting.

The reduction follows a brief rally that had seen resistance to Pepe tests around the level of $ 0.00001080. But sellers overwhelmed buyers at the time of final negotiation, investing the profits and pushing the token to the negative territory.

Despite a modest recovery in the last minutes of commerce, along with a fall in the volume that can indicate the fatigue of the seller, the feeling is still weak. Pepe has now dropped 32% of its peak of mid -July, reflecting a broader setback in the meme coins sector.

The broader Memecoin sector, measured by the Coindesk memecoin index (CDMEME) fell 22.4% during the same period.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.