Pepe

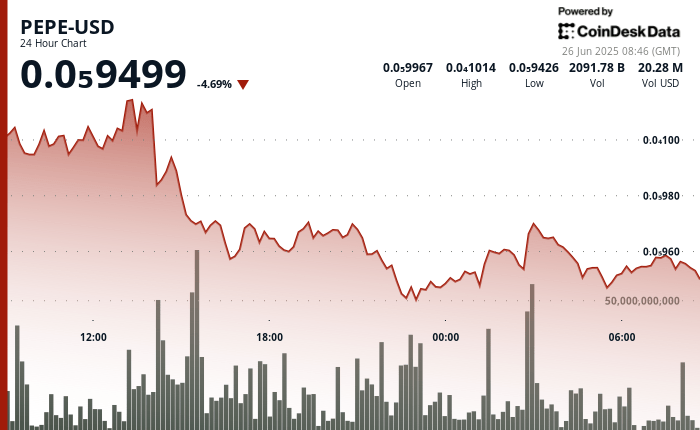

One of the most prominent memes currencies is struggling to maintain the interest of investors, falling 4.7% in the last 24 hours to $ 0.000009499, according to the technical analysis model of Cindensk Research.

The strong decline of the Token marks a continuation of its recent bearish trend, which has been marked by intense volatility and a strong intradic sale.

Once a retail favorite with viral impulse and even a brief wink of Elon Musk on April 9, Pepe has fallen into the influence of the market as attention returns to Bitcoin. Musk had briefly adopted a profile picture with the theme of Pepe that day, a movement that sent waves through the meme coin space. Even so, exaggeration has vanished to a large extent.

This recession is part of a broader change in cryptography markets, where Bitcoin’s domain has now raised above 65%, a level not seen in more than two years. The trend suggests a growing investor preference by BTC over smaller Altcoins, especially during periods of uncertainty and decreased risk appetite. That change feels acute for high beta assets like Pepe.

Despite the brief price rebounds, Pepe remains under pressure, facing resistance about $ 0.00001013. Its lack of maintenance of the manifestations reflects a broader rotation away from the memes currencies, and its future performance may depend on whether the feeling of the market returns to more risky assets or remains anchored in names of great capitalization.

TECHNICAL ANALYSIS

- PEPE-USD quoted within a range of 16.1%, falling from $ 0.00001017 to $ 0.00000940 between June 25 09:00 and June 26 08:00 UTC.

- The strong resistance was formed at $ 0.00001013 during the heavy sale between June 25, 14:00 and 16:00 UTC.

- A short -term support zone was developed at $ 0.00000946– $ 0.00000950, where the price repeatedly bounces in moderate volume at the end of June 25 and early June 26.

- During the last 60 minutes of the analysis window, from June 26, 07:07 to 08:06 UTC, the price went from $ 0.00000959 to $ 0.00000955.

- A peak of 91.9 billion units at 07:17 UTC on June 26 coincided with a brief 3.1%rally.

- Prices fell 0.9% in the last minutes before closing, reflecting the short -term gains.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.