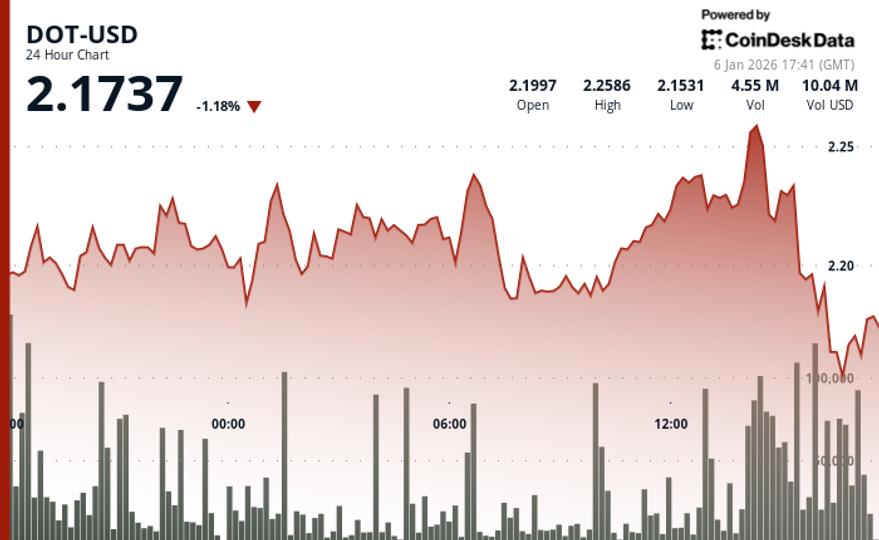

gave up earlier gains in a sharp reversal on Tuesday to trade 3.3% lower in the past 24 hours.

The token underperformed the broader crypto markets. The Coindesk 20 index was 1.3% lower at press time.

DOT volume was 17% higher than the 30-day moving average, suggesting institutional distribution rather than retail capitulation, according to CoinDesk Research’s technical analysis model.

The model showed that the day began with DOT rising to $2.17 as participation strengthened, closely tracking the broader cryptocurrency complex.

Resistance in the $2.24-$2.26 area repelled a breakout attempt, setting the stage for the subsequent breakout, according to the model.

Price deterioration accelerated as DOT broke through multiple support zones in three separate waves of capitulation, depending on the model.

This break below the critical $2.19 support level completely wiped out the daily gains and exposed portfolio managers to amplified volatility risk.

Technical analysis:

- Immediate resistance now set at $2.19

- Critical support in the $2.14-2.15 demand zone

- 24-hour volume increased 17% above 30-day moving average

- Failed breakout at $2.26 confirmed strong resistance zone

- Steep downtrend with lower highs at $2,203, $2,191, $2,187 and $2,167

- The technical structure turned decisively bearish

- Recovery Resistance: $2.19 Must Recover to Nullify Breakout

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.