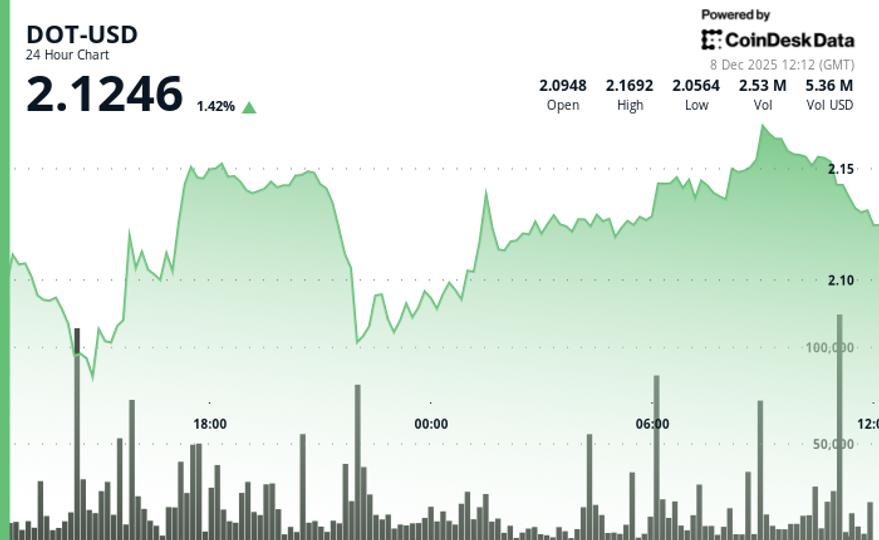

It advanced 0.8% to $2.12 in 24 hours, underperforming the broader cryptocurrency market.

The CoinDesk 20 Index (CD20) was up 2.8% at press time.

The token’s inability to match crypto market momentum indicates an underlying hesitation in investor sentiment towards the Polkadot ecosystem, according to CoinDesk Research’s technical analysis model.

The model showed that the advance occurred on substantially high trading volume, with 24-hour activity 26% higher than the seven-day moving average.

This volume pattern suggests deliberate positioning by market participants rather than low-conviction drift, although the relative underperformance indicates profit-taking outweighs new accumulation, according to the model.

DOT rose from $2.09 to $2.14 during the session, establishing an upward trend with higher lows at $2.05 and $2.09, creating a total trading range of $0.13 representing 6.1% volatility, according to the model.

The most significant volume event occurred with 5.75 million tokens traded at 134% above the 24-hour average, the model showed, driving the price through the $2.12 resistance to set session highs near $2.16.

Technical analysis:

- Strong support established at $2.05 with resistance forming near $2.16; Immediate support at $2,140 becomes critical to maintain the bullish structure.

- Exceptional volume increase of 134% above average during the endurance test; The recent 60-minute volume surge of 145,000 tokens coincides with distribution activity.

- Uptrend with higher lows of $2.05 to $2.09 conflicts with formation of descending channels on shorter time frames

- Upside target towards $2.16 resistance with possible extension if volume confirms; Downside risk towards $2.05 support represents a 6.1% range vulnerability.

Disclaimer: Portions of this article were generated with the help of artificial intelligence tools and were reviewed by our editorial team to ensure accuracy and compliance with our standards. For more information, see CoinDesk’s full AI Policy.