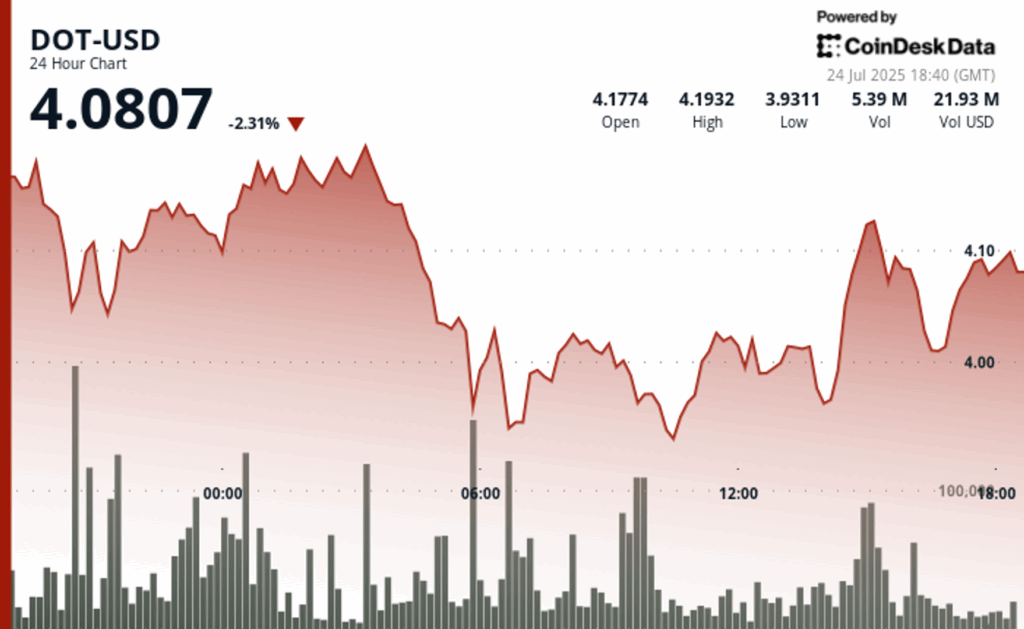

The Polkadot point organized a strong recovery after falling up to 7%, which bounced from $ 3.91 to $ 4.08 amid high negotiation volumes, according to the technical analysis model of Cinesk Research.

The model showed that the DOT navigated for swings of substantial prices during the 24 -hour period from July 23 from 7:00 p.m. to July 24, 18:00, oscillating between $ 3.91 and $ 4.20 before resolving $ 4.08.

Earlier this week, the stock and values commission (SEC) withdrew its accelerated approval for a negotiated (ETF) accelerated fund (ETF) that plans to include DOT among its main holdings for market capitalization.

The bounce in Polkadot occurred when the broader cryptographic market also increased, with the broader market meter, the Coendesk 20, recently 1.4%.

In recent negotiation, the DOT was 2% lower in 24 hours, quoting around $ 4.09.

Technical analysis:

- General negotiation range of $ 0.28 representing 7% volatility between $ 4.20 and $ 3.91 minimum.

- Critical support level established at $ 3.96 with a high volume confirmation higher than the average of 4.28 million.

- Resistance zone identified at a level of $ 4.10 showing price rejection patterns.

- Volume of 73,061 during the decrease phase indicating the institutional sales pressure.

- The recovery pattern suggests continuous potential towards the objective level of $ 4.13.

- Net decrease of 2% of the opening despite the strong rebound of the nocturnal minimums.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.