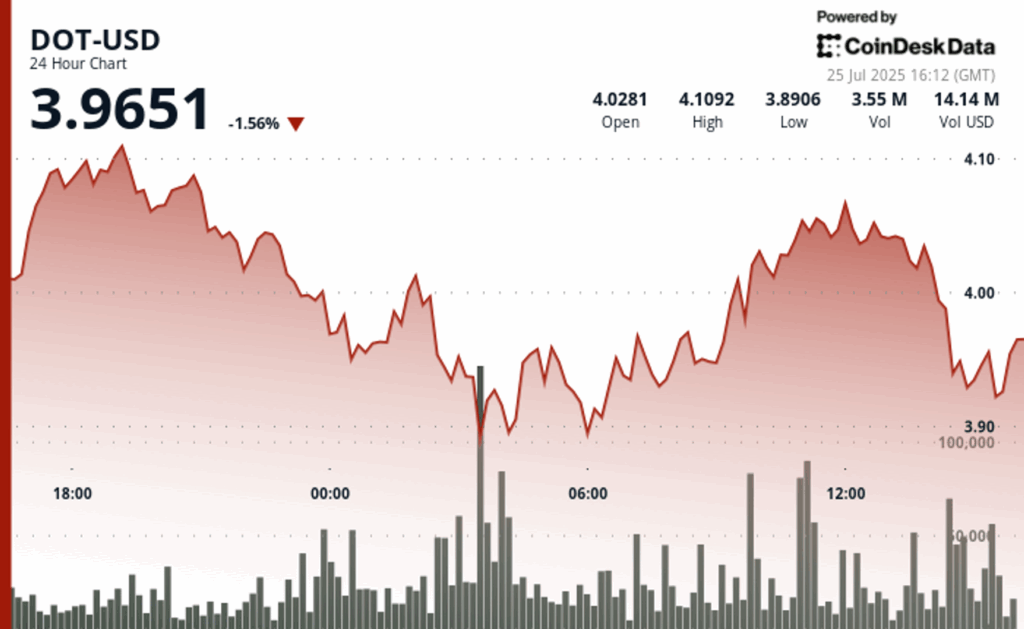

The Dot of Polkadot found a continuous bearish impulse despite several recovery attempts, fluctuating between $ 3.87- $ 4.11 throughout the period of 24 hours, according to the technical analysis model of Cindensk Research.

The model showed that a substantial institutional purchase activity was developed in critical support areas of around $ 3.87- $ 3.93, especially during volume sessions high at 03:00 and 14:00 hours.

A significant support has been developed in the range of $ 3.87- $ 3.93 with resistance to the level of $ 4.11, according to the model.

The fall in Polkadot occurred when the broader cryptographic market also fell, with the broader market meter, Coindesk 20, recently 3%.

In recent negotiation, the DOT was 1.9% lower in 24 hours, quoting around $ 3.94.

Technical analysis:

- Negotiation range of $ 0.24 that constitutes a 6% differential between the $ 4.11 peak and the $ 3.87 channel.

- The volume exceeded the average of 24 hours of 2.87 million during critical support evaluations at 03:00 and 14:00 hours.

- Robust resistance at a threshold of $ 4.11 with an intensive sale impulse that establishes an ascending movement ceiling.

- Support territory established within $ 3.87- $ 3.93 in range with important purchase interest on high volume.

- The V -shaped recovery formation emerged in the final negotiation period with a sustained rally of the minimum of $ 3.92.

- Progress above $ 3.94 resistance threshold suggesting a possible transformation of short -term feelings.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.