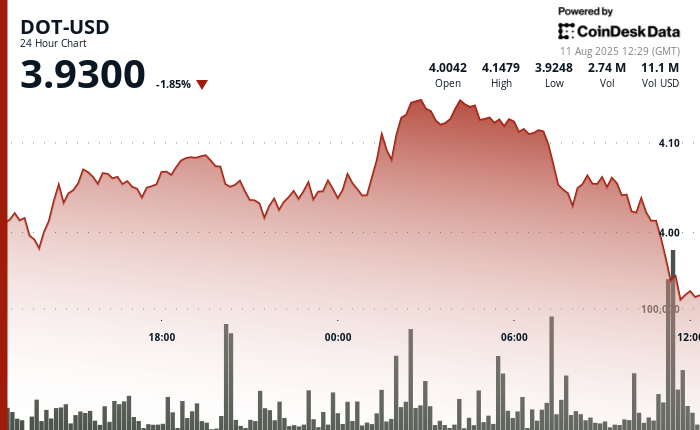

Polkadot DOT experienced considerable volatility in the 24 -hour negotiation period with strong decreases in previous earnings, according to the technical analysis model of Coindesk Research.

The model showed that DOT collapsed 6% in a dramatic investment of 24 hours from August 10 from 12:00 to August 11:00, decreasing from $ 4.15 to $ 3.91 in the midst of an exceptionally robust sales volume.

Polkadot faced a strong sales pressure as institutional liquidation promoted the lowest prices, violating multiple support thresholds, according to the model.

The DOT decrease occurred when the broader cryptographic market increased, with the broader market meter, Coindesk 20, recently 0.5%.

In recent negotiation, Polkadot was 2.6% lower in 24 hours, quoting around $ 3.91.

Technical analysis:

- Negotiation range of $ 0.24 representing 6% volatility between $ 3.91 and $ 4.15 thresholds.

- The volume increases to 4.96 million during the decrease in the final hours that indicate the institutional sale.

- Resistance established at a level of $ 4.15 after the attempt of aborted rally.

- Fragile support level about $ 3.90 with a possible risk of breakdown.

- Formation of lower maximums confirming the deterioration of the structure of the bearish market.

- Volume greater than 300,000 in multiple intervals for 11: 15-11: 30 sales pressure.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.