The Dot of Polkadot demonstrated a significant increase in the interest of the big buyers during a 24 -hour negotiation period, with corporate treasury assignments and regulatory clarity that drives the sustained purchase pressure, according to the technical analysis model of Coindesk Research.

The model showed that the price action demonstrated a potential institutional degree stability with sustained corporate interest indicators.

As of July, Bifrost had secured more than 81% of the DET Liquid Staken Token (LST) market, with more than $ 90 million in total blocked value (TVL), according to a post in X.

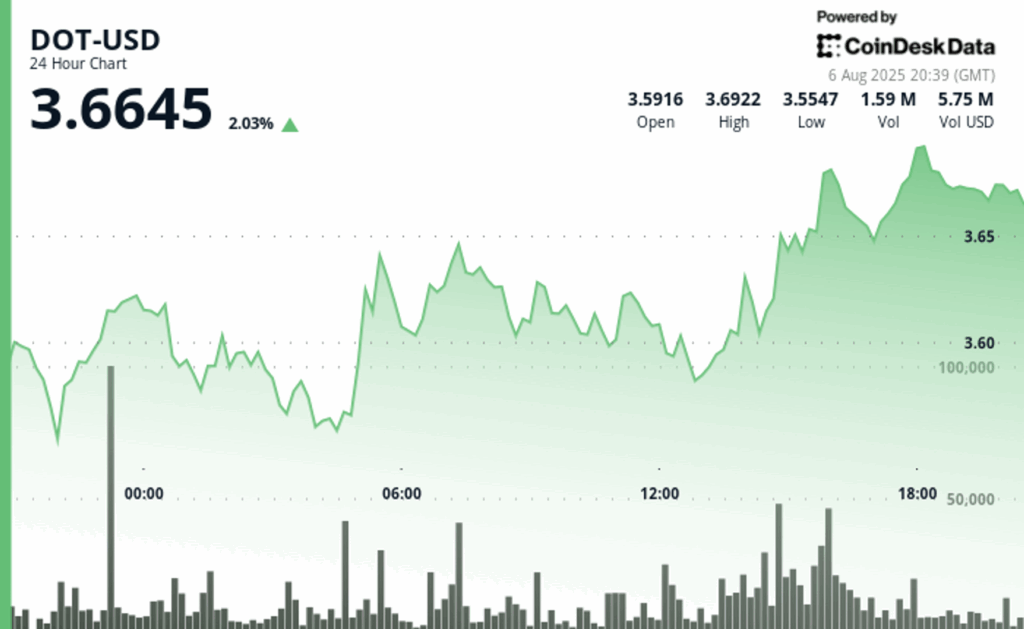

The Rally in Dot occurred when the broader cryptographic market also increased, with the broader market meter, Coindesk 20, recently 2%.

In recent negotiation, Polkadot was 2.1% higher for 24 hours, quoting around $ 3.66.

Technical analysis:

- The institutional flow patterns established strong levels of support that reflect the decisions of the Corporate Investment Committee, according to the model.

- The corporate treasure assignment discussions potentially contributed resistance formation near the key technical levels.

- The negotiation volume exceeded institutional thresholds during the standard hours of corporate decision making.

- Volume after spicy hours aligned with typical corporate advertisement patterns.

- Reduced volatility periods suggest phases of institutional accumulation before possible business adoption news.

- The price action demonstrated institutional degree stability with sustained corporate interest indicators.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.