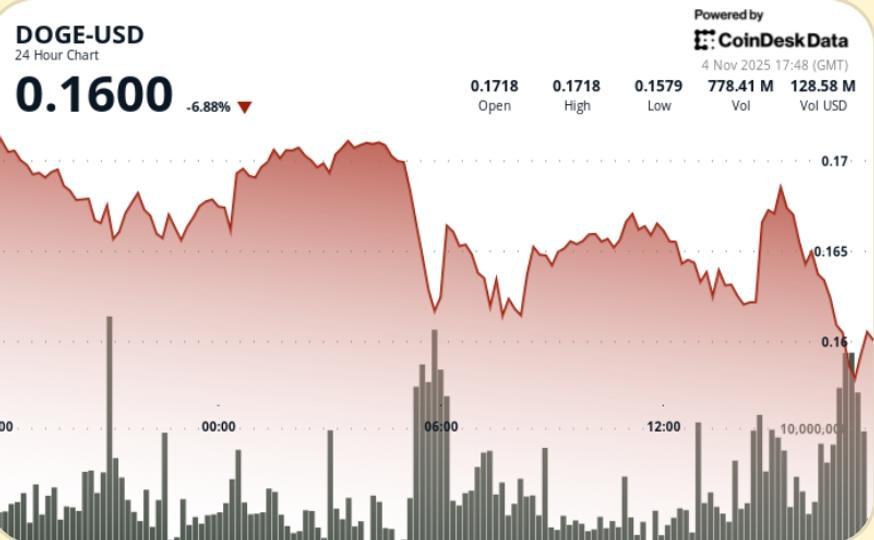

Dogecoin fell 6.7% to $0.1605 during the latest session, breaking a key support at $0.17 as the big players weakened. Volume increased approximately 76% above the seven-day average, reinforcing a clear distribution signal rather than emotional retail flow. The bears now control the structure with $0.16 acting as the next battleground.

What to know

• DOGE fell from $0.1719 to $0.1605, losing 6.7%

• Volume increased 76% above the weekly average; a spike of 1.44 billion tokens limited the rally

• Last-minute waterfall raised price to $0.1600 on 59 million DOGE block sale

• CD5 underperformed by ~1.4% → token-specific weakness

News background

The move extends a multi-session easing driven by the rotation of whales out of meme exposure and tightening liquidity in major alternative companies. A 1.44 billion DOGE wall near $0.1702 rejected buyers during the morning’s defensive attempt, triggering somewhat-led stops and accelerating the bearish leg. That failure now marks decisive overall resistance as traders lose strength until trend confirmation changes. Broader flows show reduced leverage and concentration in BTC, leaving DOGE with light bids as macroeconomic jitters weigh on higher beta bets.

Price Action Summary

• Initial fade from $0.1719 stalled near $0.1650 → then cascades to $0.1600

• Largest liquidation: ~59 million DOGE discarded between 16:20 and 16:25

• Session climax confirmed by lateral drift + post-flow volume collapse

• Highest wick rejection is $0.1702 after turnover of 1.44 billion DOGE (~158% above 24-hour average)

• Minimum printed at $0.1600; Stabilization at the end of the session, but without a strong rebound.

Technical analysis

• Trend: low-high structure, bearish continuation bias

• Support: initial defense of $0.1600; next liquidity pool $0.1550–$0.1500

• Resistance: tactical limit of $0.1630; $0.1702–$0.1714 Firm Supply Zone

• Volume: Conviction Selling – 158% increase at rejection confirms distribution

• Structure: Breakdown below $0.17 invalidates previous consolidation basis

• Momentum: Oversold readings develop but no reversal signal: downside risk without catalyst

What traders are watching

• Can $0.1600 hold in US hours or do funds force a move towards $0.1550–$0.1500?

• Return of spot offers in the face of continued net whale outflow behavior

• If CD5 stabilizes: DOGE delay increases fragility

• Reaction to any attempted bounce in the $0.1630 and $0.1700 supply zones

• Liquidity behavior if BTC volatility increases again