In the last five days, Bitcoin

It has increased from $ 116,000 to just above $ 122,000 before retiring to the current $ 119,000. Despite this price movement, the profits has remained off, with an average of less than $ 750 million per day to date.

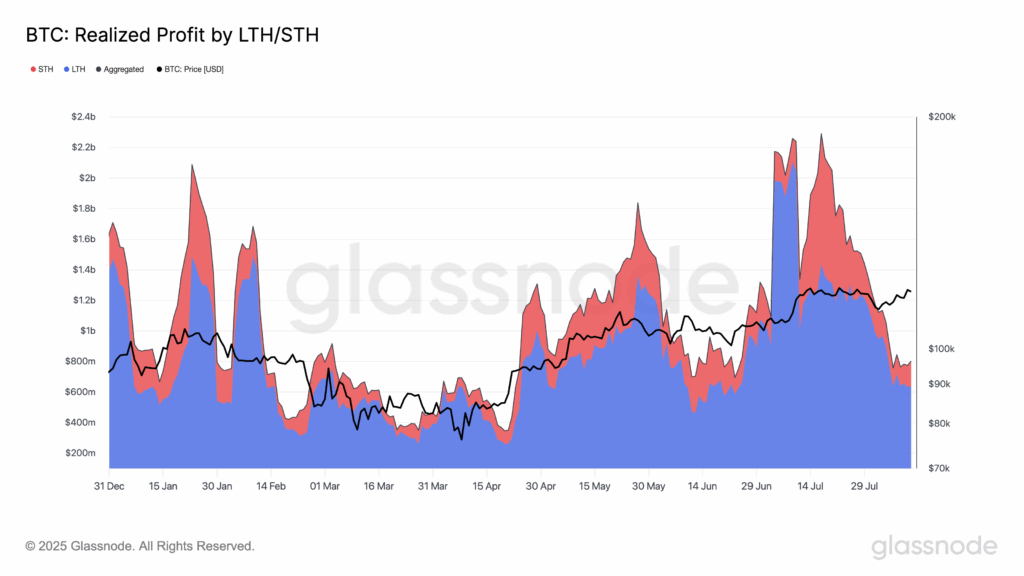

For perspective, Glassnode data shows that in January the profits made daily were around $ 2 billion, with similar peaks in July when Bitcoin reached its historical maximum of $ 123,000.

The Glassnode’s profit metric measures measures the total benefit of all spent currencies where the sale price exceeded the acquisition price. When broken by long -term holders (LTH) and short -term headlines (ST)It offers a more granular vision of market behavior. This classification is based on the weighted average acquisition date, with the LTH supply defined as holdings of more than 155 days.

The data reveal that the LTH have constantly obtained many more profits than STHS. An exception occurred in July, when the profits made by STH increased when Bitcoin reached its historical maximum. Many of these short -term earnings probably come from investors that they bought during the sale of “March tantrum”, when Bitcoin fell to $ 76,000.

The current low level of profits carried out, particularly compared to the previous market peaks, is encouraging for the bitcoin upward perspective. It suggests that holders, both long and short term, abstain largely to block profits despite recent price increases. If this trend persists, it could provide the market with the stability and impulse necessary to boost the new maximums of all time.