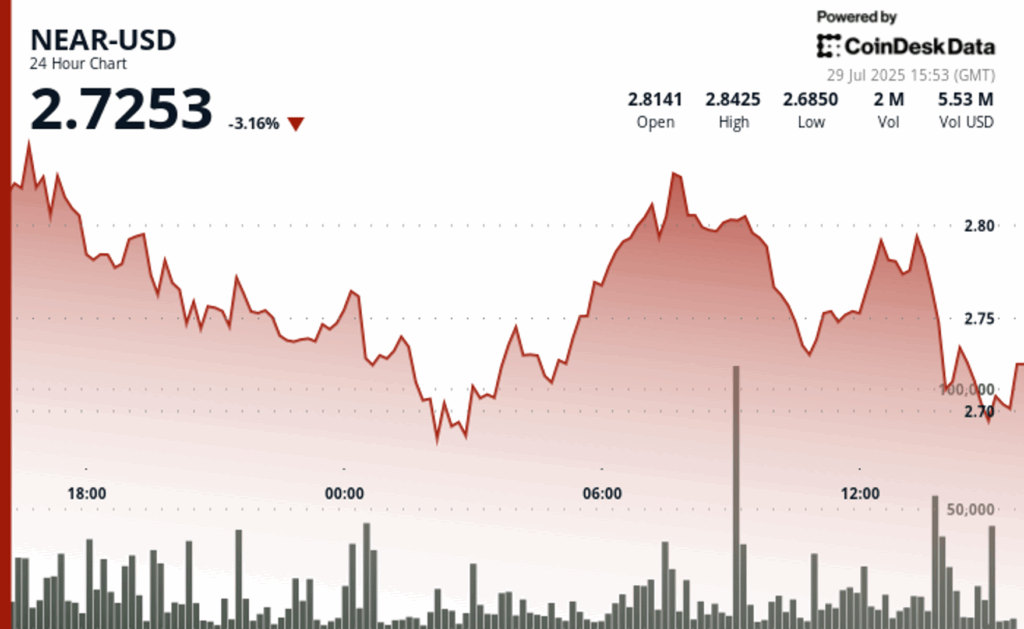

The nearby protocol registered a 3% decrease from $ 2.84 to $ 2.75 during the 24 -hour period, with assessments that are consolidated within a bandwidth of $ 0.18 before the pronounced liquidation of the catalyzed terminal time a violation through established support parameters.

Market analysis: consolidation transitions to decrease

The nearby protocol demonstrated a consolidation pattern during the previous session 24 hours after July 28 from 3:00 a.m. to 2:00 p.m., making transactions within a range of $ 0.18 between $ 2.67 and $ 2.86, which represents an added range of 7%. The cryptocurrency exhibited bearish inclinations with valuations that decreased from $ 2.84 to $ 2.75, constituting a 3% depreciation during the period.

During the final 60 minutes of July 29, 13:06 to 14:05, near the protocol underwent a dramatic reversion of the previous consolidation framework, experiencing an acute decrease of 2% of $ 2.78 to $ 2.73.

Summary of technical indicators

- The transacted assessments within a range of $ 0.18 between $ 2.67- $ 2.86, which represents 7% added volatility.

- The critical resistance arose at $ 2.83 where the valuations were reversed lower on multiple occasions.

- The support was materialized around the $ 2.73- $ 2.75 area with notable volume surge during recovery efforts.

- Transactional volumes exceeded 175,000 during maximum sales periods of 13: 50-13: 52.

- Commerce patterns suggest market indecision with decreasing volatility towards the conclusion of the session.

- Desglosse characterized by a significantly high volume during the decrease, indicating the institutional liquidation activity.

Discharge of responsibility: Parts of this article were generated with the assistance of artificial intelligence tools and reviewed by our editorial team to guarantee the precision and compliance with Our standards. For more information, see Coindesk’s complete policy.