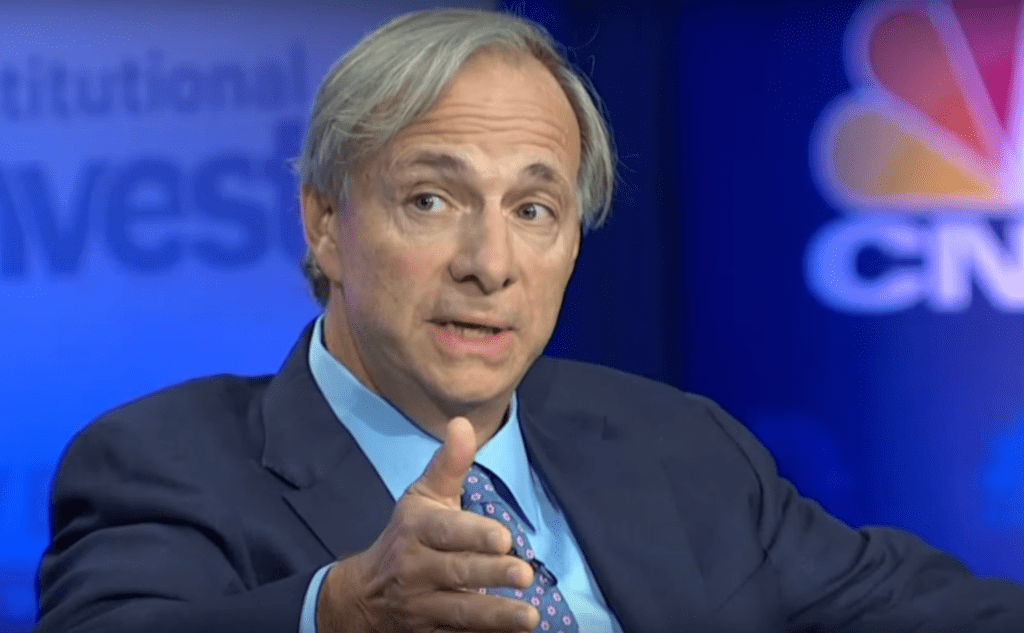

Ray Dalio sounds the alarm, not only about a possible recession, but about a deeper and more systemic breakdown of the global economic and political order in an interview with CNBC on Sunday. His concerns are not just about market volatility; They indicate a broader structural fragility.

Interestingly, Bitcoin (BTC) has shown resilience in the middle of chaos. The digital asset has broken a three -month bearish trend and is approaching $ 85,000, indicating that it can happen to a role as a possible alternative refuge.

Mixed signals continue from the White House in rates, which adds to the growing uncertainty that weighs in global markets. As a result, markets continue to be extremely volatile, especially in the last two weeks, since Trump’s tariff policies strengthen.

Dalio, the founder of the Bridgewater investment giant, focuses particularly on the growing debt and deficit of the United States. He argues that Congress must reduce the 3% federal deficit of GDP, warning that the imbalance between debt supply and investor demand could cause serious dislocations, according to CNBC.

That is already being developed in the bond market, where the treasure yields of the United States are rising. The 10 years are just under 4.5%, while 30 years are around 5%. These high yields are bringing markets and could force the Federal Reserve to intervene to calm the markets.

Dalio also warns that tariff uncertainty is feeding with broader macro instability. The US dollar, measured by the DXY index, has now fallen below 100 for the first time in years, a possible capital flight signal from the country. He is asking for a comprehensive commercial agreement with China and a currency adjustment to strengthen Yuan, with the aim of stabilizing a system that looks more and more fragile, according to the report.

In an alert comparison, Dalio compares today’s risks with those observed during the United States departure from the Gold standard in 1971 and the global financial crisis in 2008, according to the report. Both were inflection points that remodeled the financial system.

Discharge of responsibility: This article, or parts of it, was generated with the assistance of AI tools and was reviewed by our editorial team to guarantee precision and adhesion to our standards. For more information, see Coindesk’s complete policy.