The final objectives of Tokenization include full -right secondary trade markets for alternative private assets, integration and portability in the defi ecosystem and greater investment accessibility. While there are a number of platforms and service providers that offer tokenization as a service, there have generally been inherent limitations associated with carrying existing inherited assets in a dynamic way.

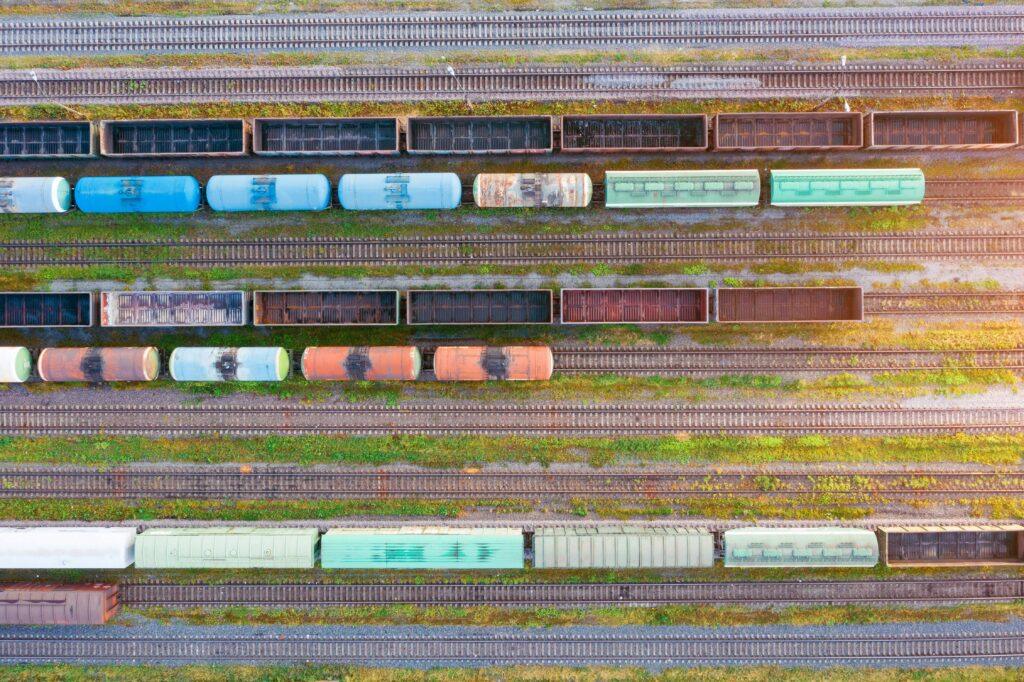

The token of a loan portfolio of a direct lender of the average market can create an opportunity to use the collateral of the portfolio as a non -crystalline collateral within applications Defi such as Moonwell, Aave or Morpho, for example. The loan workflow of asset assets of the ideal real world taken from Blue Water’s opportunities in the Tokenization 2025 report is shown below.

You are reading Crypto Long & Short, our weekly newsletter with ideas, news and analysis for the professional investor. Register here to get it on your entrance tray every Wednesday.

It is important to highlight that the concept will probably fail if the direct lender only marks their wallet holdings quarterly, semiannually or annually, since that timeline drastically delays the usual execution in real -time expected time in digital asset markets. To really unlock the billions of dollars of the current, making alternative assets in the universe, there must be an operating system or systems that allow final goal applications; These applications include decentralized exchanges, decentralized loan platforms and collateral transfers from equal to equal to constantly extracting financial asset data. But doing this for defi applications is not feasible when examining dozens or hundreds of Excel spreadsheets and isolated files in an attempt to ingest data at assets.

Below are some additional factors for consideration when changing towards blockchain environments:

1. The transparency and the martric test: the “metric” is anything, including reserves, holdings, state, authorization, etc.) are the soul of cryptographic markets. Bring inherited assets in the chain in a significant way will require transparency levels higher than average, at least for direct investors and participants.

2. Any operational speed doll that inhibits a 24/7 operational program will reduce trust and increase the risk of execution in the eyes of cryptographic investors. That means that manual updates of employees, editions and working hours will decrease the attractiveness of real world assets to cryptography markets.

3. As a combination of the first two points, experienced crypto participants will probably require a holistic solution that allows real -time monitoring of assets outside the chain that support their tokens and the speed of close execution in real time, either Operations, subscriptions, reditions or loan processing.

For example, the Inveniam Blockchain-based operating system shown here allows private assets to be crypto-national ecosystems that could not previously.

These points are not as threatening with digitally native native assets of natives as the $ 1.7 billion tradable in loans or $ 10+ billion figures in Heloc, since the complete life cycle and the associated data of these products began and still It exists in the chain in the chain. However, for the billions of dollars of the existing assets to which many in the field are directed, wearing operational and life cycle data from a variety of excel sheets to an operating system that can ingest the data, credentials in a Block and ping chain This data in real time will put things on the goal line.

Platforms such as the Inveniam operating system shown above and responsible, as well as blockchain layers, such as Chainlink and Pyth, provide some low content fruits so that asset administrators and capital market players are prepared when they incorporate to the Blockchain rails.