Bitcoin

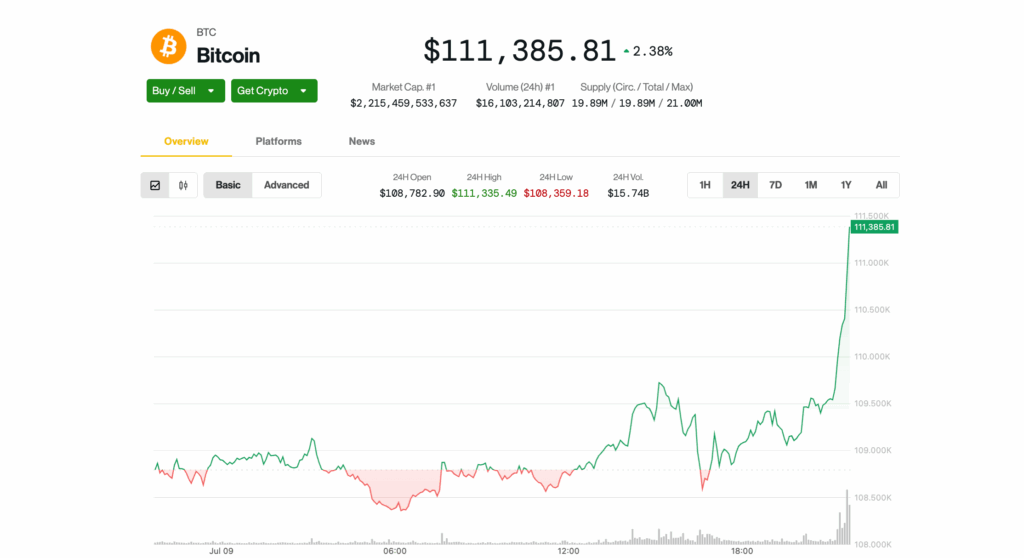

He left its recent negotiation range very tight during the afternoon hours on Wednesday afternoon, threatening to overthrow its May $ 112,000 record.

The largest cryptography briefly scored the new record prices in some exchanges, including Binance, Coinbase and Bitstamp, before retiring to $ 111,000.

The movement arrived in a broader cryptographic rally that also saw the ethereum ether

6% arises to $ 2,760, its highest level in a month. Bitcoin itself was ahead 2.4% to $ 111,400 at the time of publication.

During the highest rapid movement of today, about $ 440 million in leverage commercial positions were settled in all cryptographic derivatives, predominantly shorts anticipating shorts anticipating

For BTC, the area around the level of $ 110,000 has been a significant barrier in recent weeks, with investors that obtain profits and shorts every time the price was approaching that level.

Verification of actions related to cryptography, strategy (Mstr) It is higher by 4.4% and $ 414 only a few dollars before its highest level of 2025 (Although it is still well below its set record at the end of last year of $ 543). Coinbase (COIN) It is ahead 5%. Bitcoin Miners Mara Holdings (Mara) and riot platforms (RIOT) They rise approximately 6%.

Even so, market observers noticed that the slow and calm accumulation could be a bullish configuration.

“Crypto feels so quiet [while] Bitcoin is ready to move, “said Charlie Morris, Bytetree investment director in a report.

Morris pointed out that Bitcoin’s volatility has constantly decreased, a pattern that historically preceded great ascending movements.

“The configuration for next looks good,” he said. “As I keep saying, the quiet bulls are the best.”

Joel Kruger, Lmax Group Market Strata, said Ether’s strength over the key levels of technical support and the growing demand for long -standing institutions that bet on their future role in settlement infrastructure and asset token.

That opinion echoed the analysts of the Bitwise digital asset manager, who appointed ETH as one of the “cleaner” token to bet on the red -lived token trend, The Block reported.

UPDATE (July 9, 20:30 UTC): Add more details throughout history.