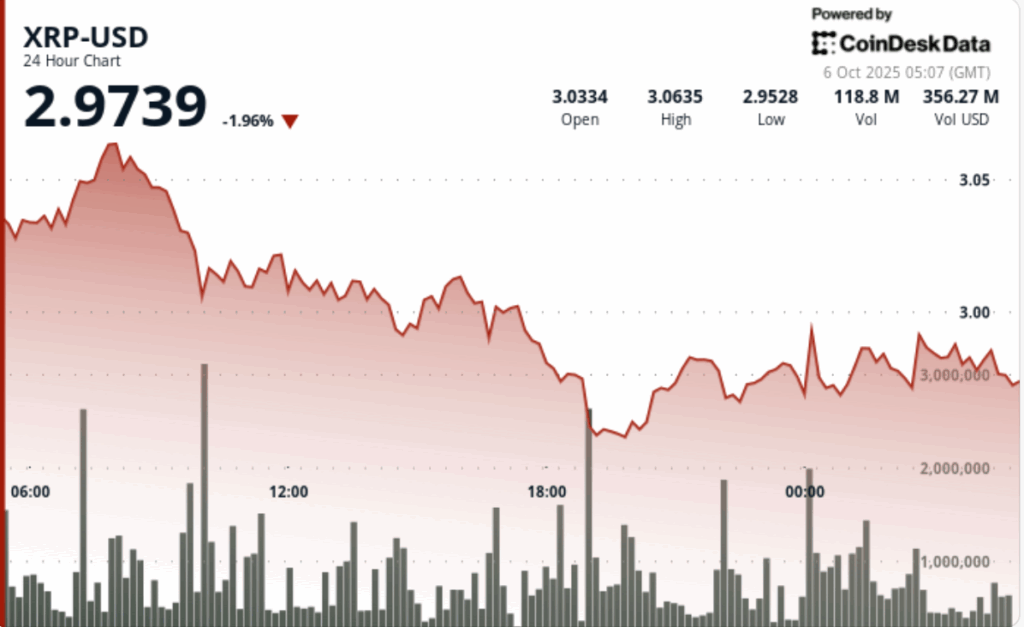

The early XRP rally at $ 3.0 Institutional impressions confirmed $ 3.07 as resistance, while repeated defenses about $ 2.98 maintained the losses contained.

News history

XRP fell 1% from October 5, 03:00 to October 6, 02:00, withdrawing from $ 3.0 to $ 2.98 despite the opening force.

The Token shot at $ 3.07 in the early hours, just to face the concentrated sale pressure.

The analysts said that institutional desks were active in resistance, with a 17% turnover above daily averages. Despite the bearish control in much of the session, XRP ended with a rebound of $ 2.98, the signage continued the interest of accumulation.

Summary of the price action

- XRP quoted a $ 0.09 corridor, or an intradic range of 3%, between $ 2.98 and $ 3.07.

- The price reached a maximum of $ 3.07 before the strong rejection in the 64.3 million tokens, compared to the average of 54.7m.

- The sales pressure dragged XRP at $ 2.98, where the support was repeatedly defended.

- A drop in the late session caused a discharge of 1.95m volume to $ 2,979, immediately absorbed by buyers.

- The stabilized price of rebound flows about $ 2.98, with recovery volumes with an average of 750k per bar.

Technical analysis

- The resistance is firmly established at $ 3.07, validated by the sales pressure above average and repeated failures to break more. The support remains at $ 2.98, where buyers constantly intervened, including a high volume discharge absorbed at the end of the session.

- Price Action reflects a rejection based on a band of $ 3.07– $ 2.98. Although the sellers dominated two thirds of the session, the defense of $ 2.98 shows that the institutions continue to accumulate in the falls, maintaining the structure intact for another higher attempt.

What operators are seeing?

- If $ 2.98 remains support in the next sessions.

- If $ 3.0 remains a hard roof or weakens under renewed pressure.

- Signs of sustained institutional entries as the ETF catalyst approach.

- Potential test of $ 3.10 If buyers can recover control above $ 3.03.