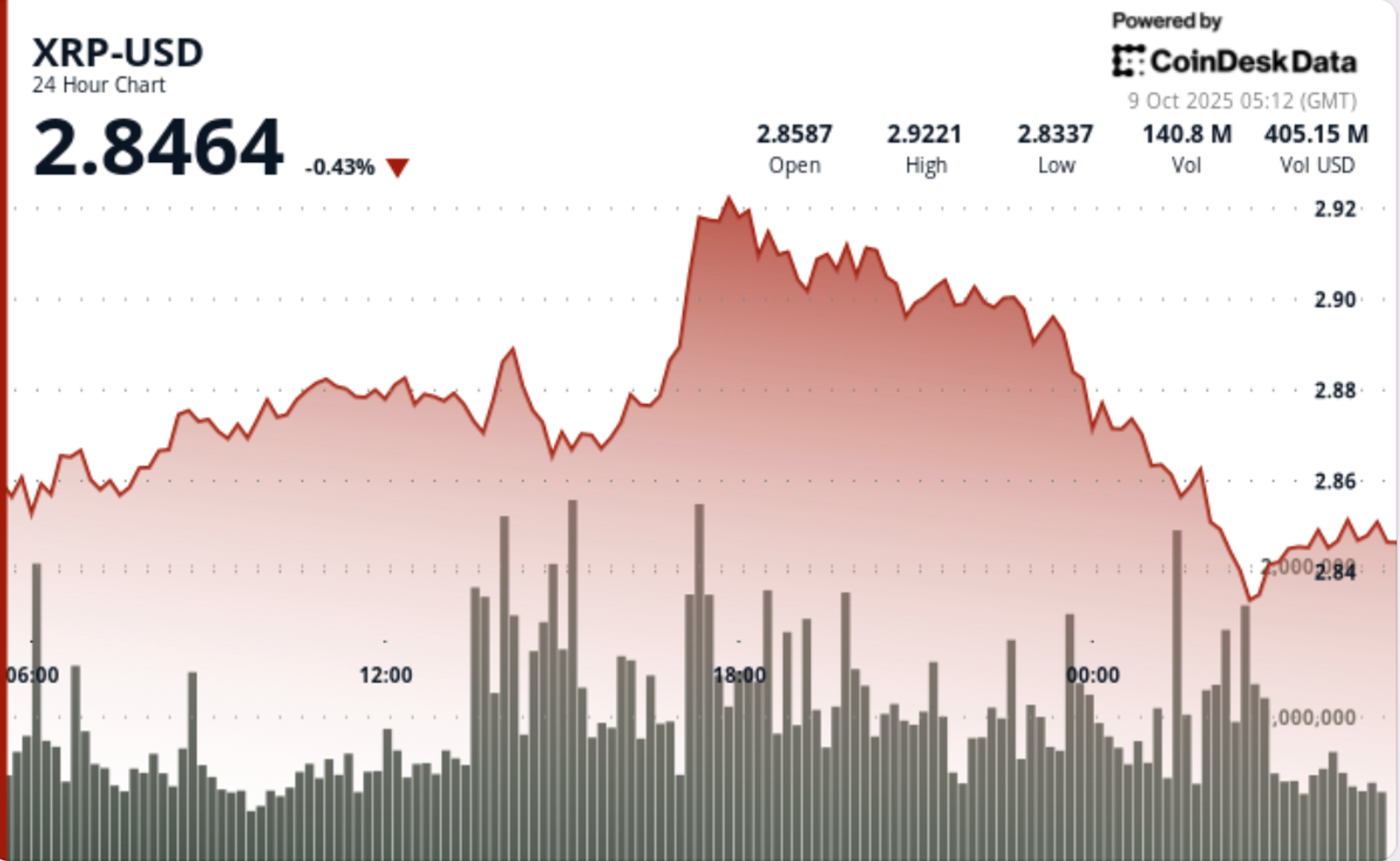

XRP soared above $2.90 with double average volume before profit-taking reversed the gains, leaving the price back at $2.85. A new supply zone formed between $2.92 and $2.93, while the $2.85 floor is now under scrutiny as macroeconomic headwinds weigh on flows.

News background

XRP rose 2% intraday on October 8, jumping from $2.88 to $2.93 at 17:00 with turnover of 86.6 million, almost double the 24-hour average of 48.3 million. The move coincided with heightened geopolitical tensions and central bank maneuvers, which fueled greater volatility in risk assets. Traders noted that despite stronger institutional adoption trends, profit-taking dominated until the US close.

Price Action Summary

- XRP traded a $0.08 corridor (3% range) between $2.85 and $2.93.

- The afternoon break through the $2.90 resistance hit a high of $2.926 before reversing.

- The rally established a supply zone between $2.92 and $2.93.

- At closing time, the price fell from $2.86 to $2.85, and a volume of 2.97 million confirmed a breakout.

- XRP closed at $2,851, down 2.5% from intraday highs.

Technical analysis

Support at $2.86 broke under heavy selling pressure, turning that level into short-term resistance. The next floor is at $2.85, and any decisive break opens the risk towards $2.80. Resistance remains between $2.92 and $2.93, where high volume rejection occurred. While the price structure shows bearish momentum in the near term, institutional accumulation themes and regulatory catalysts still support broader positioning.

What are traders watching?

- If $2.85 remains as a short-term floor or yields up to $2.80.

- A retest of the $2.92 to $2.93 supply zone if momentum picks up.

- Macroeconomic catalysts: Fed policy expectations and trade tensions affect risk flows.

- ETF and regulatory clarity issues that could re-anchor institutional offerings.