Technical reversal signals emerge amid extreme oversold conditions following an aggressive institutional distribution wave.

News background

• Whale wallets dumped nearly 200 million XRP (~$400 million) in 48 hours, triggering acute supply pressure

• Market-wide risk aversion intensified as Bitcoin fell below $90,000, driving altcoins into higher volatility.

• Bitwise’s new XRP ETF saw $25.7 million in first-day volume and $107.6 million in assets under management, indicating strong institutional demand

• Sentiment among major companies remains fragile, and the total crypto market capitalization continues to fluctuate due to heavy capital outflows

Price Action Summary

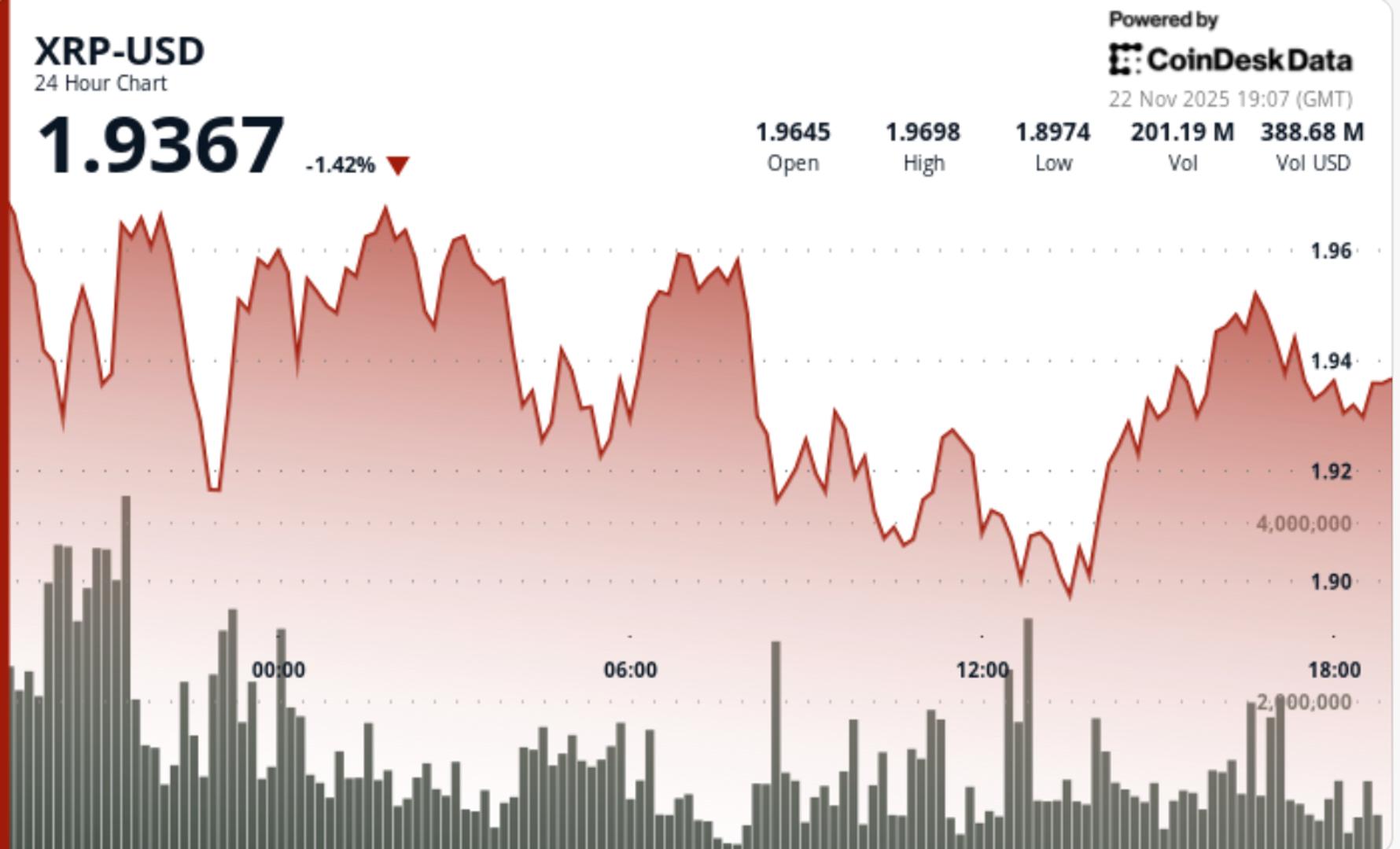

• XRP fell from $1.96 → $1.91, marking its lowest close in three sessions

• Volume increased 67% above average to 182.1 million, confirming institutional sales.

• A descending channel dominated the session with intraday volatility of 5.1%.

• The capitulation bottom formed at $1.895, followed by a 0.5% reversal at the end of the session.

• Last hour volume increased to 2.76 million, breaking the pattern of declining activity.

Technical analysis

The XRP session reflected a classic distribution-driven decline followed by reversal signals in the early stages. The whale selling created sustained downward pressure as major holders offloaded nearly 200 million tokens, overwhelming the $1.96 resistance band and pushing XRP into a descending channel that persisted for most of the session.

Support between $1.90 and $1.91 emerged as the key battleground. The psychological level attracted aggressive buying after a capitulation event at $1,895, where institutional inflows reversed the intraday trend. Momentum indicators, including the RSI and short-term stochastic, showed deeply oversold conditions, creating the first bullish divergence since last week’s big crash.

The sharp volume increase of 2.76 million during the bounce suggests early accumulation behavior, contradicting the previous multi-hour share drop. Still, the macro structure remains fragile. The bulls must force a clean break above $1.96 to invalidate the descending channel and attempt to reverse the trend. Failure to defend the $1.90 level would expose the chart to a quick extension towards $1.82 and then $1.73.

What traders should keep in mind

• $1.90 is still the line in the sand. A lower close opens the way to October’s deep pockets of liquidity

• Recovering $1.96 is essential to neutralize the descending channel and restore short-term bullish momentum.

• ETF flows, especially Bitwise’s AUM trajectory, may provide upside catalysts if volume accelerates

• Divergences and oversold signals favor short-term rebound attempts, but whale distribution remains the dominant risk

• Fear levels across the market remain high; XRP will continue to overreact to Bitcoin volatility