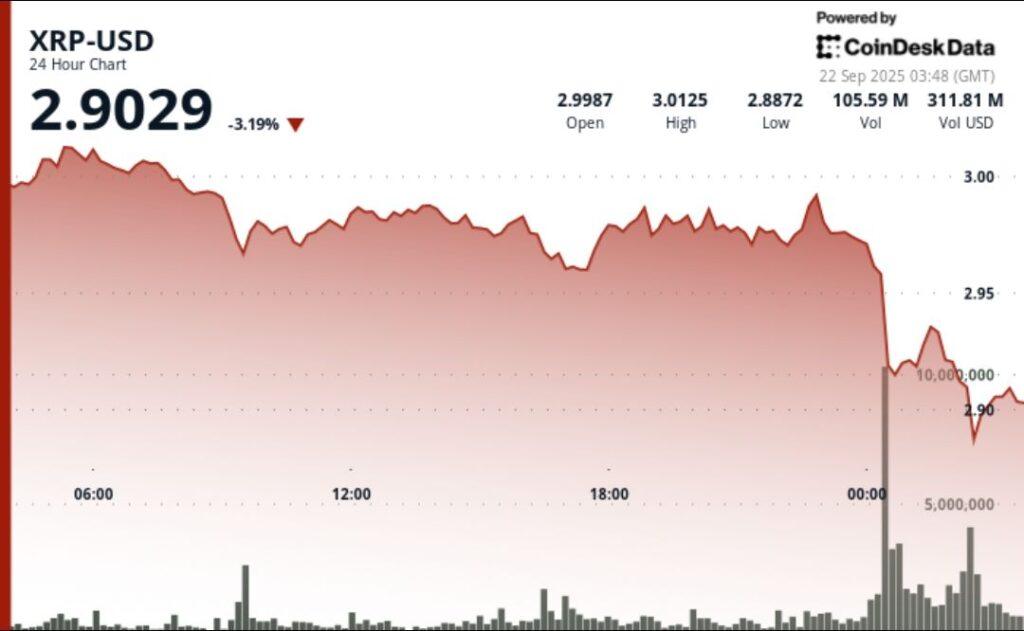

XRP endured a volatile 24 -hour session from September 21 to 03:00 to September 22 at 02:00, balanced 3.46% between a maximum of $ 3.014 and $ 2,910 minimum.

The mass sale coincided with the debut of the first ETF XRP that quotes in the United States, which established records with $ 37.7 million in volume of the opening day, but the institutional profits overwhelmed the upward catalyst.

News history

• The first ETF XRP that quotes in the United States was launched on September 21, generating $ 37.7 million in volume of day one, the largest 2025 ETF debut.

• The flexibility of the Federal Reserve policy remains in focus, with market prices almost the certificates of September rates cuts that generally support digital assets.

• Analysts warn about structural consolidation despite the time of the ETF, with resistance that persists about $ 3.00.

Summary of the price action

• XRP fell 3.46% during the 24 -hour period, collapsing from $ 3.0 to $ 2.91 before closing at $ 2.92.

• Midnight Crash drove the price of $ 2,973 to $ 2,910, unleashing 261.22 million in volume: Quadruple daily averages.

• Liquidations totaled $ 7.93 million during defeat, with 90% reaching long positions.

• The 60 minutes saw XRP bounce from $ 2.92 to $ 2.94, only to retire to $ 2.92, creating a resistance cluster at $ 2.93- $ 2.94.

Technical analysis

• Negotiation range: $ 0.104 in the section that represents a 3.46% volatility between $ 3,014 and $ 2,910 minimum.

• Resistance established at $ 2.98- $ 3.00 after high volume rejection.

• The support zone was formed at $ 2.91- $ 2.92, repeatedly tested after the blockade.

• Consolidation emerged about $ 2.92 at the final hour, since XRP did not remain above $ 2.93.

• The volume explosion of 261M confirms the institutional sales waves that dominate the flows during the night.

What merchants are seeing

• Can XRP claim and sustain closures above $ 3.00, or resistance to $ 2.98- $ 3.00 upside?

• How the secondary flows of the new ETF affect liquidity, given the participation of the day one of the records.

• The September rate decision of Fed and if the policies of Dovish Sparks renewed the cryptographic entries.

• Exchange of reserves to 12 months maximum, indicating a possible supply despite the institutional interest.