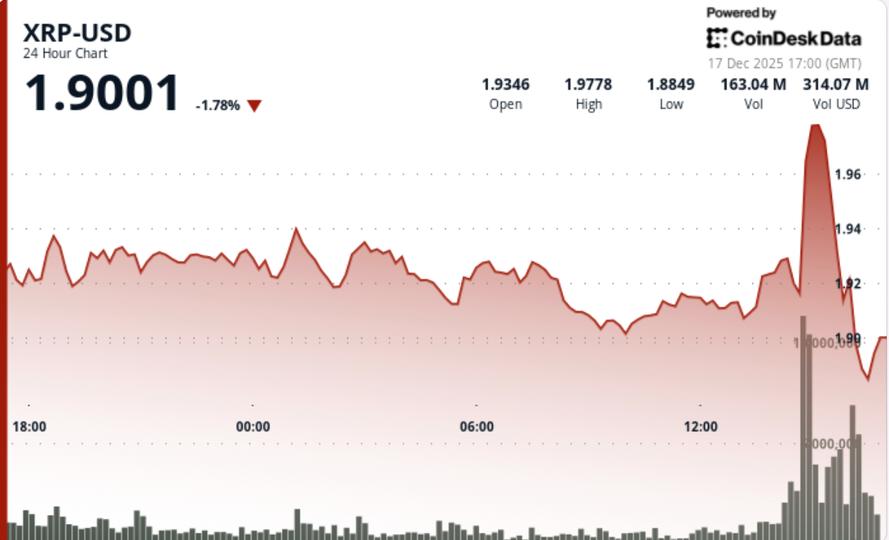

XRP fell sharply on Wednesday, breaking below the $1.92 support zone as elevated selling pressure collided with violent volatility among assets during US trading hours.

The move came amid sharp swings in bitcoin, U.S. stocks and AI-linked stocks, leaving altcoins exposed as liquidity tightened and derivatives positioning reset.

News background

- Crypto markets saw violent bullwhip action in early US trading, with Bitcoin briefly rising from $87,000 to over $90,000 before returning to the $87,000 zone.

- The reversal coincided with heavy losses in AI-linked stocks, including Nvidia, Broadcom and Oracle, which fell between 3% and 6%, dragging the Nasdaq down more than 1%.

- Sentiment weakened after reports that Blue Owl Capital pulled out of funding a $10 billion Oracle data center project, putting pressure on risk assets tied to AI infrastructure.

- The sudden changes triggered more than $190 million in cryptocurrency liquidations in four hours, with $72 million in long positions and $121 million in short positions, according to CoinGlass.

- XRP slightly underperformed the broader market as derivatives-driven flows hit mid-beta altcoins the hardest during the volatility surge.

Technical analysis

- Support: Immediate: $1.90, now the first line of defense Secondary: $1.75-$1.64, deeper liquidity zone if $1.90 fails

- Resistance: Short term: $1.94 – $1.99, previous support turned into supply. Psychological: $2.00, now firmly rejected.

- Volume Structure: The rejection near $1.9885 printed the highest volume of the session. High activity confirms distribution, not passive selling. There is still no evidence of seller exhaustion.

- Trend Structure: A break below the key Fibonacci retracement changes the structure to a downtrend. Lower highs formed before the rejection, indicating a decline in momentum. Consolidation resolved downwards.

- Momentum Check: Failed compression above $2.00 acted as a bullish trap. Price acceptance below $1.94 keeps the downside bias intact.

What traders are watching

- If $1.90 level holds: A clear breakout quickly exposes $1.75 to $1.64.

- Reaction if the price retests between $1.94 and $1.99: the rejection confirms the continuation of the trend.

- If macroeconomic volatility decreases or continues forcing deleveraging between assets.

- Derivatives Positioning After $190M Settlements: Direction Depends on Who Reloads First.

- The relative performance of XRP vs. BTC if bitcoin stabilizes near $87,000