General description of the technical analysis

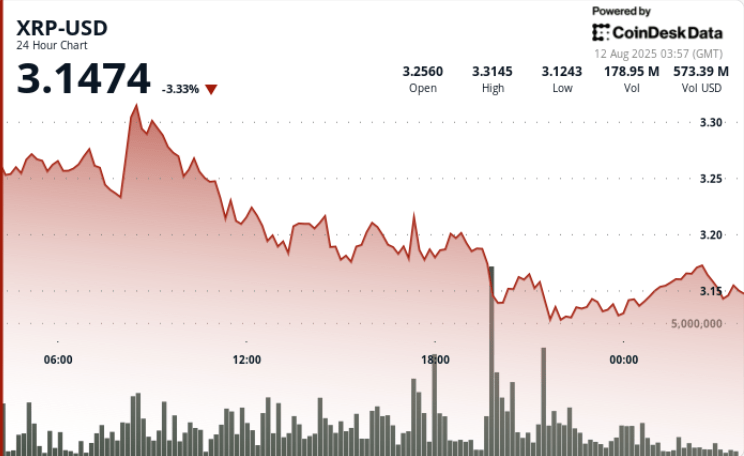

XRP falls 2% in the 24 -hour period ending on August 12, sliding from $ 3.19 to $ 3.14 after touching an intra -duty peak of $ 3.32 at 08:00. The measure is produced after two days of two -digit earnings in regulatory clarity, with a sale pressure concentrated at 7:00 p.m., a drop of $ 3.20 to $ 3.15 in 73.87 million volume.

The support is maintained at $ 3.13 after multiple successful tests, while the resistance accumulates at $ 3.27, establishing a short -term defined range. Final time trade considers a rebound of $ 3.13 to $ 3.14 in the late purchase, with volume peaks of 3.21MY 4.45m of signaling of salsa purchase interest.

News history

Ripple Labs and the stock exchange and securities commission have formally completed their legal battle of almost five years, jointly dismissing the appeals in the XRP case. The agreement eliminates a significant start of compliance, unlocking greater institutional participation. Daily negotiation volumes have increased 208% to $ 12.4b from the announcement, with an open interest also rising.

Despite the legal advance, the broader cryptographic feeling remains linked to macro factors, including ongoing international commercial disputes and changing monetary policy expectations.

Summary of the price action

• XRP decreases from $ 3.19 to $ 3.14 on August 11 01: 00 – Window of August 12 00:00

• Intradía of $ 3.32 at 08:00 you find strong resistance, which causes a sale

• 19:00 TIME SEE $ 3.20 to $ 3.15 Fall in the volume of 73.87m: the heaviest printing of the session

• Confirmed support at $ 3.13; Blocked resistance to $ 3.27

Market analysis and economic factors

The setback reflects the natural gains taking after the Rally after the XRP settlement. The big headlines seem to be rebuilding positions while keeping offers of $ 3.13- $ 3.15, indicating that there is no deterioration in the longest feeling. Macro uncertainty continues to influence broader flows, although XRP’s regulatory clarity gives it a relative versus pair insulation.

Analysis of technical indicators

• Support: $ 3.13 (multiple tests backed by volume)

• Resistance: $ 3.27- $ 3.32 (repeated rejection)

• Intradía range: $ 0.19 (6% volatility)

• The heavy volume of 19:00 suggests a coordinated institutional sale

• Late session accumulation maintains the price above $ 3.13

What merchants are seeing

• Break potential above $ 3.27 to resume the ascending impulse

• Stability of $ 3.13 Support in more earning waves

• Persistence of institutional entries after regulation.

• Effects of the macro spill of commercial developments and monetary policies