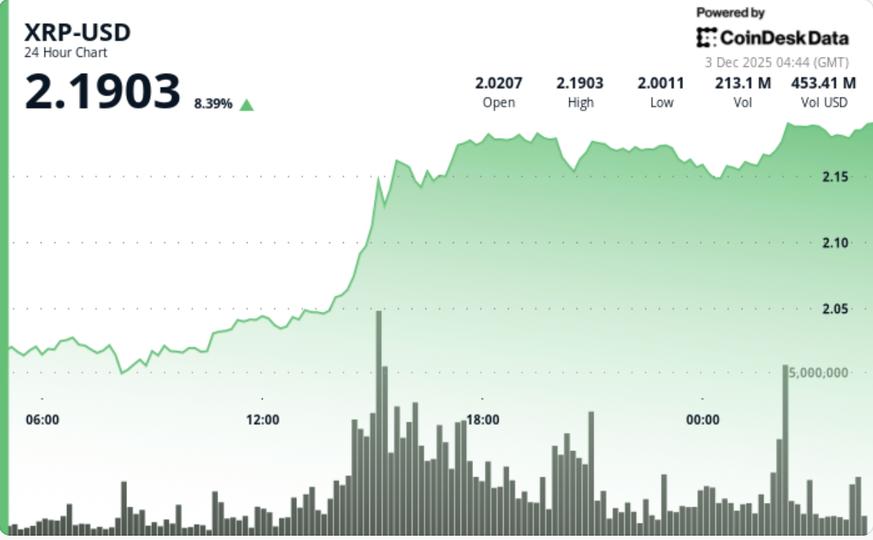

XRP surpassed the crucial $2.10 resistance with an explosive surge in volume, marking its strongest breakout in weeks as technical and on-chain catalysts finally aligned in favor of the bulls.

• XRP jumped from $2.03 to $2.17 as buyers overwhelmed sellers at key resistance levels

• Volume increased 182% above average during the breakout window at 15:00 GMT

• XRP Ledger network activity hit multi-year highs, with over 40,000 account pool trades

• AMM-related positioning accelerated as regulatory clarity drove developer growth and liquidity.

• Institutional accumulation manifested itself in consecutive bursts of large volume above 1 million units.

XRP’s break above $2.10 confirms the completion of a multi-day compression structure that formed along the $2.00 support shelf. The increase in volume (more than double the 24-hour average) validates the move and indicates coordinated institutional participation rather than retail speculation.

The rally formed a clear ascending structure with consecutive higher lows at $2.00, $2.04, and $2.155. This upward curvature strengthens the ascending triangle that has been building for more than six months. XRP is now approaching the upper limit of the structure with an increasing probability of continuation.

Momentum indicators are turning bullish in a way not seen since the great historical rallies. The weekly stochastic RSI crossed upwards from oversold territory, a pattern previously observed before

XRP traded within a range of $0.14, starting the session at $2.03 before rising to $2.17. The breakout occurred at 15:00 GMT during a volume burst of 200.5 million, by far the strongest activity of the day. After breaking above $2.10, the token recorded new highs of $2,181 during the 02:12-02:13 window, supported by multiple volume spikes of over 3 million. A consolidation band formed between $2,155 and $2,180 as late trading showed sustained accumulation rather than distribution.

• $2.17–2.18 is now the first resistance; Clearing it opens the way to $2.33-$2.40

• Between $2.00 and $1.98 remains the structural support zone and the invalidation level for the breakout.

• Sustained volume over 1 million per hour indicates real buildup and reduces the chance of pullback traps.

• Ascending triangle remains active with multi-month breakout implications

• Bullish Stochastic RSI Crossover + Rising Network Activity Provides Strongest Confluence Since Early 2024 Rallies