XRP rose from $2.60 to $2.68, breaking through the $2.63 barrier and establishing new support between $2.61 and $2.63.

News background

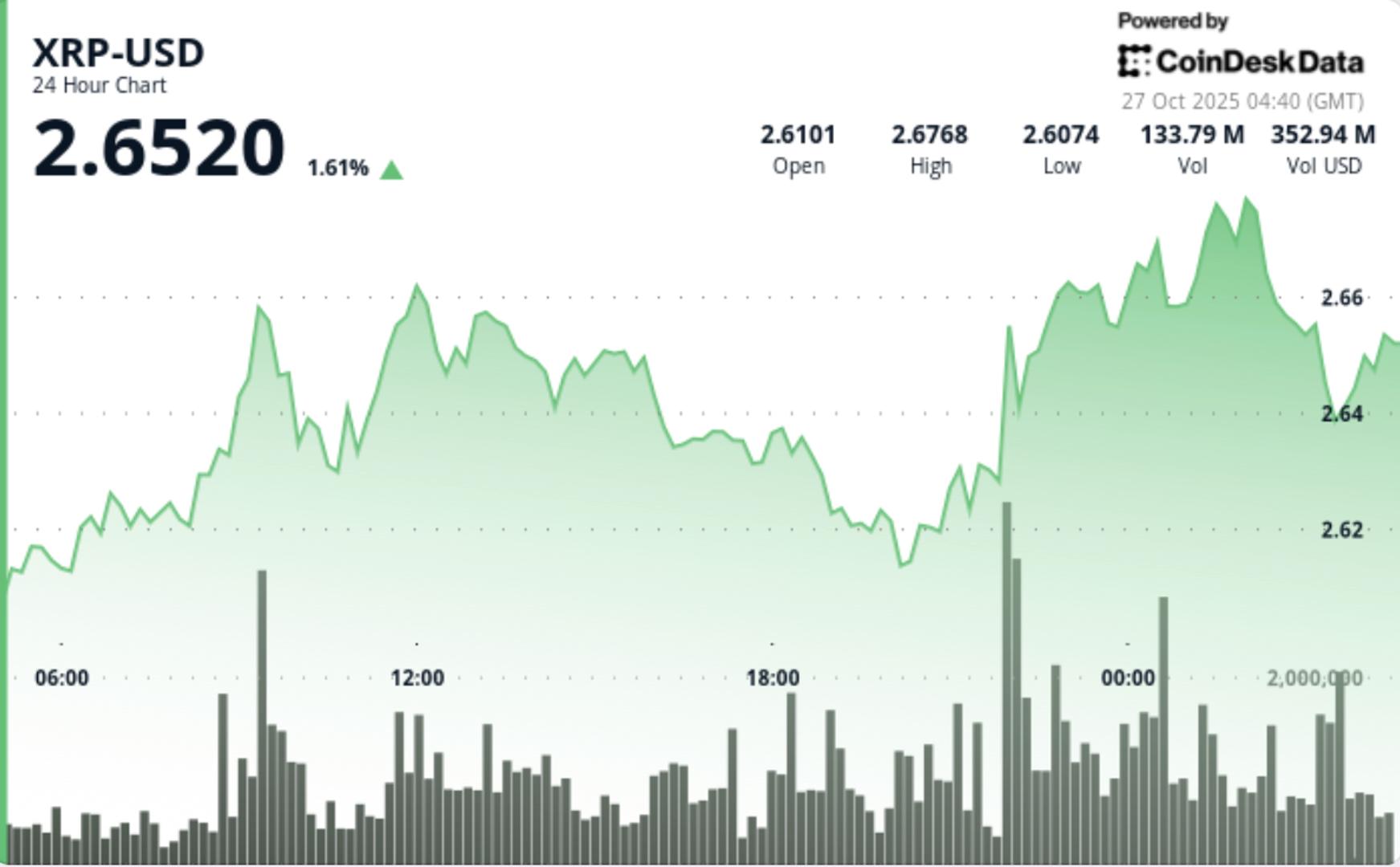

- XRP rose 3% to $2.68 during the session on Sunday, surpassing the critical resistance level of $2.63 in a dramatic volume surge, one of the largest of the month.

- The breakout aligns with growing institutional interest, supported by recent comments from fund managers noting that “hundreds of millions” are flowing into XRP exposure vehicles.

- The move also comes ahead of expected regulatory and ETF developments, which many analysts believe could accelerate demand.

Price Action Summary

- XRP rose from $2.60 to $2.68, breaking through the $2.63 barrier and establishing new support between $2.61 and $2.63.

- Trading volume reached approximately 106.5 million units in a single breakout hour, an increase of 147% above the previous 24-hour average.

- The token traded in a tight range of $0.08, illustrating disciplined accumulation rather than erratic speculation.

- The price action was characterized by higher lows that reinforced the breakout structure, and late-session consolidation near $2.67 suggested buyers were defending gains rather than exiting.

Technical analysis

- The structure now defines a break above a multi-session resistance zone with strong volume confirmation, a textbook signal of institutional accumulation.

- Support between $2.61 and $2.63 is newly anchored, while immediate resistance lies in the area between $2.70 and $2.75.

- Volume patterns confirm the move: a large spike at the breakout, followed by lower volatility during consolidation, pointing towards absorption. Key momentum indicators (RSI, MACD) remain constructive on the daily charts, aligning with broader breakout psychology.

What traders need to know

- Traders are now watching two critical behaviors: first, whether XRP can hold the $2.63 support base; retesting and maintaining would validate the break.

- Second, if volume remains high or increases again, the breakout has a higher probability of extending towards the $2.70-$2.75 area.

- On-chain flows and commentary on institutional products (e.g. comments from Teucrium Trading executives about large inflows) support the accumulation narrative.

- On the risk side, a sustained close below $2.61 would undermine the breakout and could trap the price back in its previous consolidation range.