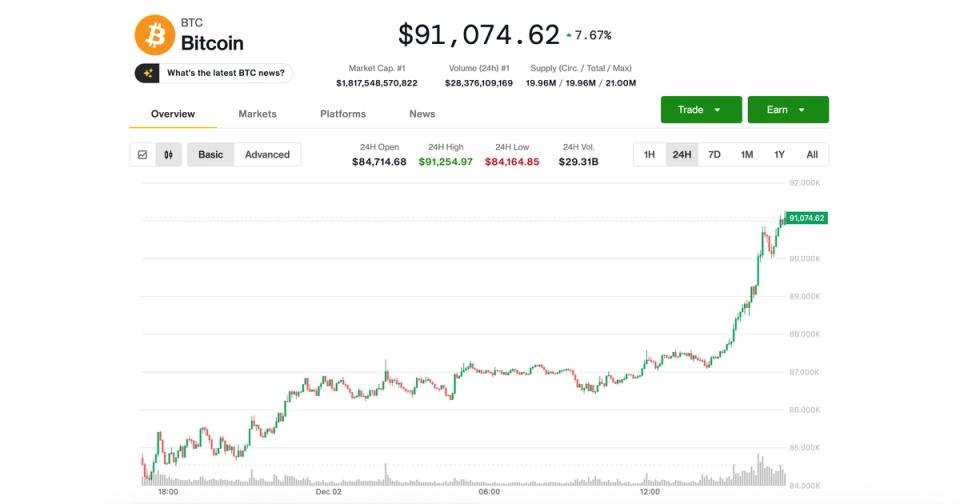

bitcoin It rose above $90,000 again during Tuesday morning hours in the US, erasing most of its sharp decline from Sunday to Monday to below $84,000. The largest cryptocurrency was recently trading at $91,180, up 8% in the last 24 hours, helping to boost the broader digital asset markets.

Ethereum ether rebounded above $3,000, gaining 9% over the same period. Large-cap altcoins also followed the advance: SOL from Solana , They rose between 7% and 10%, recovering from their recent lows.

The gains came as $11 trillion asset management giant Vanguard abandoned its long-standing fatwa against cryptocurrencies and will now allow its clients access to digital asset ETFs. Additionally, Bank of America has given the go-ahead that their wealth managers recommend a 1% to 4% allocation to bitcoin spot ETFs.

Japan Yield Shock Could Hit Bitcoin Hard, Analyst Warns

Mark Connors, founder and chief macro strategist at Bitcoin investment advisory Risk Dimensions, and former global head of risk advisory at Credit Suisse, warns that a rise in Japan’s 10-year yield could draw capital away from global markets, with cryptocurrencies, especially bitcoin, hardest hit due to their proximity to Asian capital flows and exposure to leverage. Binance, which handles nearly half of all cryptocurrency volume and allows up to 50x leverage, is particularly vulnerable to yen and yuan volatility.

Connors also noted that bitcoin appears to be leading the S&P 500’s decline. That pattern could continue until both the Federal Reserve and the Bank of Japan hold their monetary policy meetings later this month. If markets weaken further, expect some form of intervention, as has often happened during periods of stress in recent years.

Still, not all signs point to weakness. Jasper De Maere, strategist at Wintermute, said bitcoin derivatives show a “clear tilt toward bullish and short-volatility behavior.” Traders are selling short put options around the $80,000 to $85,000 level, while selectively buying upside further out.

“The combination suggests a market that views $80,000 to $85,000 as supported and is comfortable leaning toward the end of the year while gaining carry along the way,” De Maere said. In other words, despite the near-term pressure, traders appear positioned for a recovery.

Read more: On thin ice: Crypto Daybook Americas