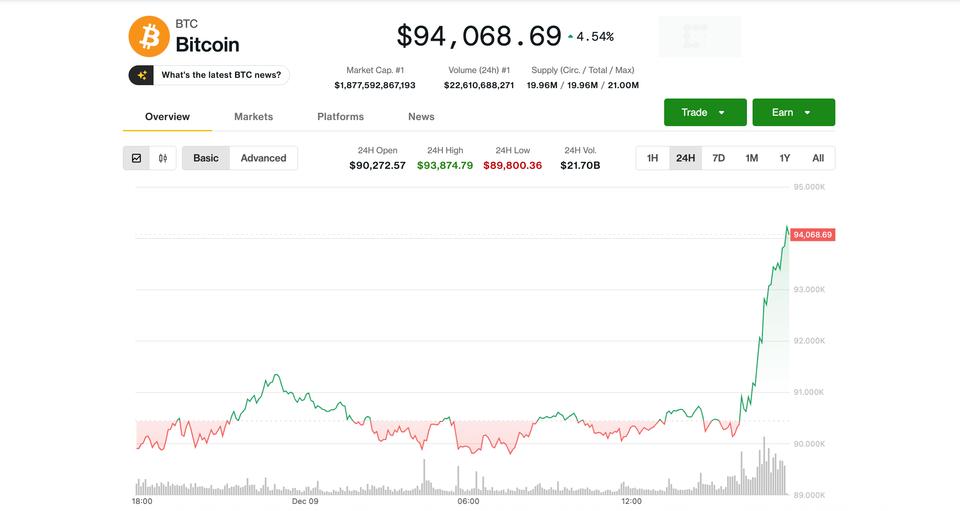

What started as a slow US morning in cryptocurrency markets has taken a quick turn, with bitcoin retaking the $94,000 level.

Sitting just above $90,000 early in the day, the largest cryptocurrency rallied back to $94,000 minutes after 16:00 UTC, gaining over $3,000 in less than an hour and up 4% in the last 24 hours.

Ethereum ether jumped 5% over the same period, while native tokens of and chain link it went up even more.

The stock declined as silver rose to new all-time highs above $60 an ounce.

While overall stock markets remained stable, cryptocurrency stocks followed bitcoin’s advance. Digital asset investment firm Galaxy (GLXY) and bitcoin miner CleanSpark (CLSK) led with gains of more than 10%, while Coinbase (COIN), Strategy (MSTR), and BitMine (BMNR) rose between 4% and 6%.

While there was no single obvious catalyst for the rapid bullish move, for weeks BTC has been primarily selling off alongside the opening of US markets. Today’s pattern change could indicate sellers’ exhaustion.

Vetle Lunde, principal analyst at K33 Research, noted a “deeply defensive” positioning in crypto derivatives markets, with investors concerned about further weakness, and overcrowded positioning possibly contributing to the rapid recovery.

More signs of bear market capitulation also emerged on Tuesday as Standard Chartered bull Geoff Kendrick cut his outlook for the bitcoin price for the coming years.

The Coinbase bitcoin premium, which shows the BTC spot price difference on US-focused exchange Coinbase and offshore exchange Binance, has also turned positive in recent days, indicating demand from US investors is returning.

Digging deeper into the market structure, the daily rise in BTC price outpaced the rise in open interest in the derivatives market, suggesting that spot demand is driving the rally rather than leverage.

The Federal Reserve is expected to cut benchmark interest rates by 25 basis points at its two-day meeting ending Wednesday. While the rate cut is largely anticipated by market participants, looser financial conditions with a resilient US economy could help bolster risk appetite in markets.

UPDATE (December 9, 16:55 UTC): Add details on price gain versus open interest increase.