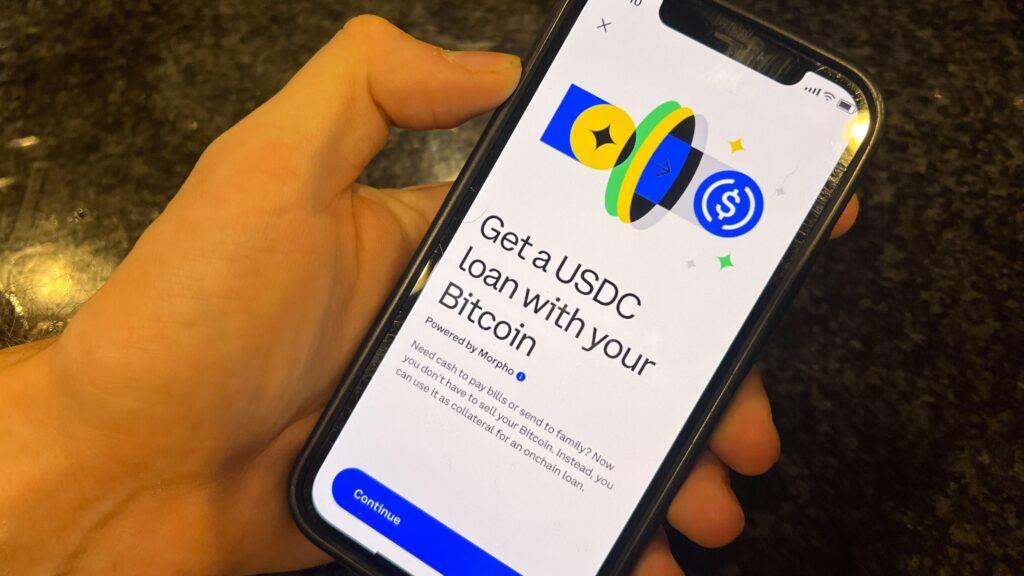

Coinbase (COIN) is adding bitcoin-backed loans to its US product lineup, leaning on Morpho, the largest lending platform on its Base network, to attract eyeballs and wallets to its growing on-chain economy.

The lending product is not entirely new: those familiar with playing on Base have long been able to borrow USDC against their bitcoin on Morpho or through other DeFi services. What’s new here is easy access: Coinbase is integrating Morpho’s lending books into its own highly popular user interface, removing a critical barrier to entry.

“This is a moment where we are planting a flag that Coinbase is coming on-chain, and we are bringing millions of users with their billions of dollars,” said Max Branzburg, head of Consumer Products at Coinbase.

Personal loans in the on-chain world look fundamentally different from the predominant loan offerings offered by banks and lenders. These stalwarts of the regular economy depend on borrowers’ credit scores to decide whether to grant a loan and determine its terms, whether it is secured or unsecured.

But credit scores don’t exist in cryptocurrencies. Platforms like Morpho don’t need to estimate how good their borrowers are for money. Instead, they require their borrowers to provide extensive collateral; in fact, much more than the sum they intend to borrow. This setup protects platforms from having bad debts from defaulters.

Coinbase’s setup limits each loan to $100,000 in USDC. To borrow that amount of money, customers will need to post more than that amount of bitcoins. Morpho will begin liquidating the collateral if the loan-to-value ratio gets too close to the sun.

“If price swings reach any kind of dangerous point, we will share liquidation warnings through the Coinbase app so you are aware and can take action,” Branzburg said.

Cash lending is the foundation of all financial services, but it has additional appeal for cryptocurrency traders, who are often left with hoards of tokens that they refuse to sell. Such traders often take out loans to conduct airdrops and finance other risky operations. In Coinbase’s view, the loans facilitated by Morpho could help borrowers undertake perhaps nobler endeavors, such as buying a car or paying for a house.

Under the hood, the new setup powers Coinbase’s flywheel at every turn. First, the launch adds a new capability to the Coinbase interface. Second, users posting BTC collateral are minting cbBTC (Coinbase Wrapped Bitcoin) and borrowing USDC (Coinbase Stablecoin). Third, all of this is happening on Morpho (a Coinbase-funded lending platform) on top of Base (Coinbase’s Layer 2 network).