Intense institutional activity drives a 38% volume surge, while XRP lags the broader crypto rally, indicating selling pressure hidden beneath the surface.

News background

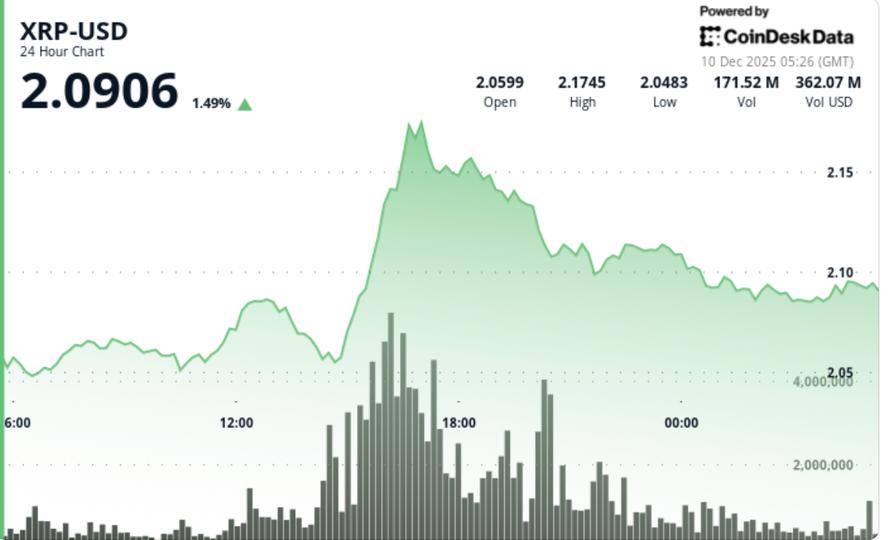

- XRP gained 0.50% to $2.0925 during trading on Tuesday, but materially underperformed the broader crypto market by 1.77%. Despite the modest advance, trading volume increased by 37.94% above weekly norms, indicating significant institutional participation.

- However, the high volume failed to translate into sustainable bullish momentum. XRP briefly broke through the $2.12 resistance and touched $2.17 before reversing sharply. The move suggests that large holders used the liquidity window to unwind positions rather than accumulate.

- The backdrop to the session reflected broader rotation themes: large companies like BTC and SOL attracted capital inflows, while XRP order books showed a more aggressive supply-side liquidity deployment, consistent with distribution during rallies.

Technical analysis

- XRP’s failure to hold above $2.12 confirmed that this level is entrenched resistance.

- The pattern of a breakout immediately followed by a rejection usually indicates distribution, especially when accompanied by high volume: 189.7 million tokens exchanged hands during the attempt, far exceeding trend norms.

- The structure now reflects a short-term compression between $2.083 and $2.17, forming a broad equilibrium zone where liquidity is being reorganized between buyers and sellers.

- Higher lows from $2.083 provide some stabilization, but the inability to maintain momentum above $2.12 keeps the bias neutral to bearish.

- Momentum oscillators are showing a slight bullish divergence from the low of $2,083, but this is offset by declining volume of recoveries and the overall supply created by the failed breakout.

- Until XRP demonstrates conviction through $2.17 (with volume validation), the technical setup remains range-bound with latent selling pressure.

Price Action Summary

- XRP opened the session with slight strength but quickly fell to $2,083 before stabilizing. A two-stage recovery took the token to $2.17, but heavy selling immediately emerged at that level.

- Volume during this push spiked to 184% above the 24-hour SMA, highlighting institutional involvement in the reversal.

- From there, XRP fell to the $2.09 to $2.10 band, where it consolidated until the close. The $2.09 level acted as psychological and technical support, absorbing flows but failing to produce significant bullish follow-through.

- Ultimately, the session reflected a controlled distribution: strong volume on advances, weak continuation afterwards, and a consistent presence of sellers above $2.12.

What traders should know

- XRP’s ability to maintain $2.09 will dictate the near-term direction. A break through this level exposes $2.05 and $2.00 as next support zones.

- The upside recovery requires a clean recovery to $2.12 and ultimately $2.17, levels where strong selling pressure emerged. Without solid volume confirmation, any move into these zones risks further distribution.

- Institutions appear active but not cumulative. Their involvement is more aligned with collecting liquidity during volatility spikes than creating directional exposure.

- If broader crypto strength persists, XRP may lag until overall supply is removed. Watch for narrowing ranges and decreasing volume – the first signs that accumulation is once again favoring buyers.