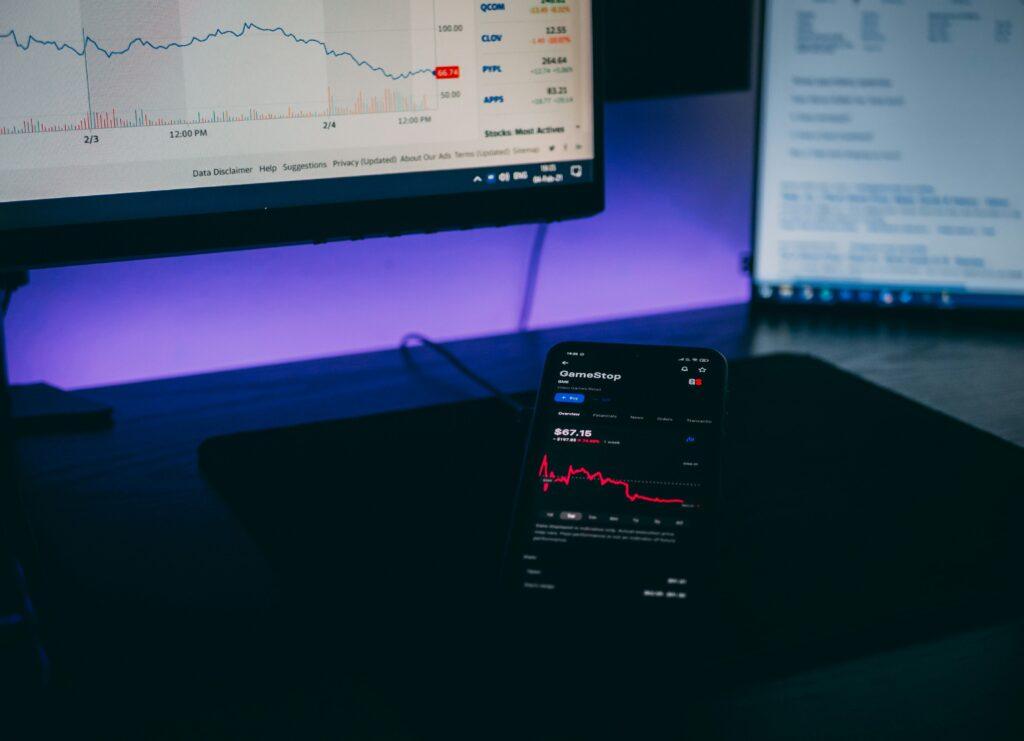

Gamestop’s shares (GME) fell almost another 6% on Thursday while investors continued to sell the news of the company’s dissemination of their initial acquisitions of Bitcoin.

The company on Wednesday morning said it had acquired 4,710 Bitcoin, a long -awaited movement linked to its cryptographic treasury strategy revealed in March. At that time, the company initiated a capital increase of $ 1.3 billion to help finance BTC purchases.

The action collapsed shortly after a strong fall in the largest markets in Trump’s release rates. However, the shares played with the fund of the markets in the middle of the month and rose more than 60% in the weeks prior to Wednesday’s announcement.

The decrease since, now about 20%, it could be little more than investors who sell the news after the great highest race or could be the exhaustion of investors with the corporate strategies of the Bitcoin Treasury, which apparently have been reaching a rate of one or more per day for several weeks.

In addition, the acquisition of Gamestop of “only” approximately $ 500 million Bitcoin (the dates and prices of purchases were not revealed) could be a disappointment given the capital increase of $ 1.3 billion of the company, not to mention several billions of dollars in free cash that was already in the balance. With a market capitalization of $ 14 billion, Bitcoin’s purchase of the company was relatively modest.

Discharge of responsibility: parts of this article were generated with the assistance of the AI tools and reviewed by our editorial team to guarantee the precision and compliance with our standards. For more information, see Coindesk’s complete policy.