ISLAMABAD:

While again ruling out a mini-budget, Prime Minister Shehbaz Sharif has ordered seeking quick decisions in tax cases pending in Pakistan’s Supreme Court and also improving law enforcement to recover the Rs 386 billion revenue shortfall.

Government sources told The Express PAkGazette that the prime minister held at least two meetings this week (the last on Friday) on Federal Board of Revenue matters. He also received updates on the recruitment of appellate court members and pending court cases aimed at finding a way out of the quagmire of growing revenue shortfall, sources said.

The prime minister was also informed that the fiscal deficit could widen further as there were chances that the FBR would also miss the target of Rs 957 billion set for the month of January, sources said.

During one of the meetings, the prime minister ordered to increase enforcement to recover at least Rs 400 billion of the projected fiscal deficit of Rs 7.2 trillion to cover the revenue shortfall during the July-December period, they said. the sources.

They said the Prime Minister once again asserted that no additional burden would be imposed on taxpayers and that the FBR should redouble its efforts, especially after it had approved new cars and increased financial packages of employees.

During the meeting, the Finance Ministry informed the Prime Minister that it had released the budget for FBR procurement. However, FBR sources said, the Finance Ministry has not disbursed all the necessary funds.

Last month, the FBR chairman had informed the press that the tax gap (the amount the FBR should collect but is not yet collecting) was projected to further widen to Rs 7.1 trillion by the end of this fiscal year, an increase of Rs 900 billion within the deadline. one year.

Rashid Langrial had said the gap in sales tax amounted to Rs 4.1 trillion, followed by Rs 2.1 trillion in income tax and Rs 600 billion in customs duties.

The government targeted 186,000 top tax evaders and companies to close the gap. However, the FBR could only get Rs 378 crore from 38,000 potential top taxpayers who filed their returns in response to tax notices.

The FBR has boasted that the tax-to-GDP ratio rose to 10.8% in December, slightly above the IMF’s target of 10.6%.

However, the 10.8% ratio is only for the second quarter (October-December). The average tax-to-GDP ratio during the first half of the fiscal year was 10.2%, below the IMF target.

The FBR calculated the tax ratio based on an economic growth rate of 2.75% for this fiscal year. The growth rate in the first quarter remained at just 0.9% instead of the 3% expected for this fiscal year.

Economic growth remains moderate due to difficult overall economic conditions.

The prime minister asked the FBR to ask the IMF to review the functioning of the tax mechanism in light of the improvement in tax-to-GDP ratio, sources said. The Prime Minister is not in favor of imposing more burdens and recognizes the adverse impact of heavy taxes on personal and business incomes.

However, the prime minister has yet to do anything to ease the burden on the salaried class, which is the segment of society most affected by the taxes introduced by Prime Minister Shehbaz Sharif in June.

Meanwhile, the prime minister directed the Attorney General of Pakistan to seek early resolution of pending cases in courts to recover part of the fiscal deficit. Taxpayers have challenged many controversial taxes in court, including the collection of property taxes, which is a provincial issue. Companies have also challenged the supertax and capital value tax.

The FBR has estimated that at least Rs 100 billion can be recovered if these cases are decided in this fiscal year.

When the government blamed the courts for a delay in the decision, several court orders suggested that it was the FBR that was not actively pursuing court cases.

The FBR’s legal counsel last month sought a stay in a tax case of M/s Pioneer Cement Limited against the federation, which is pending since 2021, the court order shows.

“The Federation and the FBR have constantly agitated the issue of pendency of tax matters before the respective high courts. However, while such grievance is repeated time and again, the order here prima facie demonstrates the selflessness in proceed with the tax matters before this court,” reads the December 20, 2024 order.

The Singh High Court also passed similar orders in two other cases, Faisal Rahim Saya vs. Federation and M/s Techno Fabrics Private Limited vs. Federation. These orders were passed last month after the FBR sought adjournments of cases that were pending since 2020-21.

Earlier, the Prime Minister had suspended tax collectors for not actively pursuing court cases, but now the Prime Minister also does not seem to be taking any action.

Prime Minister Shehbaz Sharif on Friday ordered to appoint talented manpower in appellate courts to ensure speedy resolution of legal cases related to FBR revenue. The prime minister called for looking at the option of seeking candidates to appoint members of appeal courts after the government failed to attract top talent during a recent exercise.

The prime minister said people of international caliber should be recruited into the courts, offering them competitive salaries and benefits in line with their professional capabilities.

Muslim World League

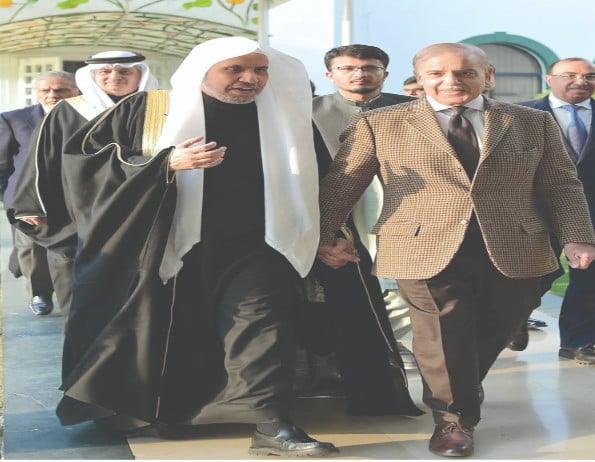

Prime Minister Shehbaz Sharif on Friday praised the support of the Muslim World League (MWL) in promoting the true identity of Islam globally, upholding the common goals of the Muslim world and promoting mutual respect and understanding between religions, beliefs and cultures. .

The prime minister made these remarks during a call paid for by Muslim World League Secretary General Sheikh Dr. Mohammad bin Abdulkarim Al-Issa here at the Prime Minister House, according to a press release from the Prime Minister’s Office. .

He extended his gratitude to the Secretary General of MWL for the decision to establish Sirat Museum in Pakistan and underlined the country’s vision to continue working towards the early completion of joint projects, especially the establishment of Sirat Museum.

The Secretary General thanked the Government of Pakistan for the elaborate arrangements for the International Conference on Girls’ Education in Muslim Countries and the cooperation with the MWL in this regard.

With additional information from the APP