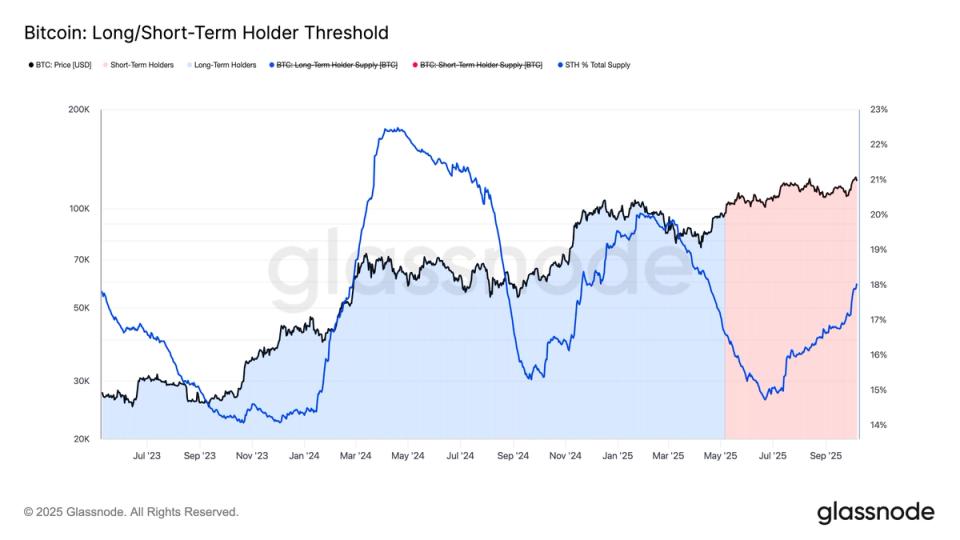

Short-term (STH) holders have added approximately 450,000 BTC to their supply since July and now own around 2.6 million BTC, according to Glassnode data.

STHs are defined as investors who purchased bitcoins in the last 155 days.

This surge marks the third distinct cycle of increased STH activity since early 2024 and typically marks a local high in the price of bitcoin.

The first peak occurred in April 2024, shortly after bitcoin’s March all-time high of $73,000.

The second peak occurred in January 2025, aligning with the all-time high of $110,000, and the last so far, the third peak has followed a new record of $126,000.

A smaller cohort of STHs has been observed in each successive cycle, suggesting that general market euphoria and speculative behavior is gradually fading.

Across these three peaks, STH supply as a percentage of total circulating supply has decreased from 22% to 20% and now stands at approximately 18%, according to Glassnode data.

At the beginning of Q1 2025, STHs held up to 2.8 million BTC, but their supply fell to around 2.1 million BTC as bitcoin declined to $76,000. This indicates that STHs were a major driver of the selling pressure seen in April.

In contrast, long-term holders (the opposite of STHs) began reducing their position during the summer months, distributing approximately 250,000 BTC since July as Bitcoin consolidated, and now own 14.5 million BTC.

As Bitcoin enters its historically strongest period of the quarter, the expectation is that STH supply will continue to rise and reach new cycle highs at over 3 million BTC.